Whether you’re a parent or grandparent, you no doubt want the very best for the children in your life.

That’s why paying for a child’s fees to a prestigious private school is a common goal that many people have, looking to provide the very best education available.

But just how much does this cost? Read on to find out the average rate of private school fees in the UK, and the benefits of sending your children or grandchildren to a fee-paying school.

Average costs of private schools vary from around £5,000 to almost £13,000 each term

With roughly 2,500 private schools in the UK, you may be able to imagine that the average cost of private schooling varies greatly.

Fees depend on a range of elements such as the age of the pupil, whether they board, and the reputation of the school itself.

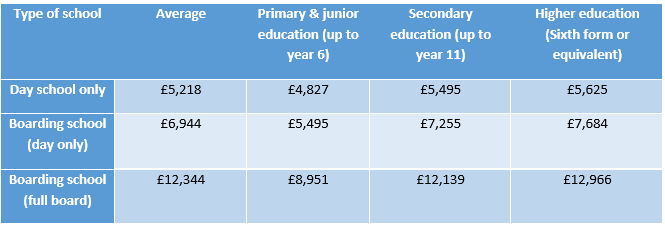

The table below shows average weighted fees each term, as collated by the Independent Schools Council (ISC) in the ISC Census and Annual Report 2022:

With the majority of pupils attending day private schools, that means you can likely expect to pay around £5,218 each term on average – a total of £15,655 each school year.

Of course, other factors can influence fees, especially where schools are located. For example, according to the ISC census, day private schools in the north-west have average termly fees of just under £4,000.

Meanwhile, this rises to nearly £6,250 for each term at day schools in London.

As a result, you may end up paying more or less than the average, depending on where your child goes to school.

Private school pupils tend to climb to the highest jobs in many professions

The other major consideration you may have over whether to pay for your child or grandchild’s school fees is how much value they receive for your money.

In short, the answer is quite a lot, on average.

YouGov polling suggests that children who attend private schools subjectively tend to believe that their education is above average in quality. Out of 253 private school attendees, 79% described their education as “pretty or very good”.

As for prospects of higher education, the ISC’s census shows that the majority of ISC school leavers continue to higher education. Of these individuals:

- 58% continue to a “Top 25” UK university – including Exeter, Durham, UCL (University College London), and Edinburgh

- 4% continue to Oxford or Cambridge

- 19% take up university places at institutions ranked 26th to 50th in the UK.

Beyond higher education, research carried out by educational charity The Sutton Trust and published in the Guardian in 2016 goes a long way in showing the benefits of a private education for career prospects.

Despite just 7% of the population attending fee-paying schools, privately educated pupils accounted for:

- 71% of top military officers

- 74% of top judges working in the high courts and appeals court

- 61% of the country’s top doctors

- 51% of leading print journalists

- 32% of MPs.

As you can see, even though the schools had far fewer pupils, the research revealed that they were more likely to be successful in these key professions.

Paying school fees can have Inheritance Tax advantages

Outside of wanting the very best for a child or grandchild, choosing to pay school fees for a loved one can also come with valuable Inheritance Tax (IHT) advantages.

When calculating the size of your estate, certain gifts that exceed any gifting allowances you have may be excluded from the calculation, depending on the specific circumstances of the gift.

Crucially, this can include gifts that you regularly make from your income. That means, if you pay for school fees – a regular payment that you can prove you have consistently made over time – then this value may be excluded when calculating your estate on your death.

There are some rules to bear in mind when doing this:

- The gift must come directly from your income

- The gift must be regular

- You must not gift money you need to live your lifestyle.

So, while the upfront costs of school fees are high, paying them with money you don’t need to live your lifestyle could ultimately reduce the size of your estate and, as a result, a portion of an IHT bill.

Speak to an expert if you’d like to find out more about how this works.

Want help achieving your financial goals? We can help

If you’d like help organising your finances so that your money can support your loved ones, please do get in touch with us at Rosebridge.

Email enquiries@rosebridgeltd.com or call 01204 300010 to find out more today.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production