Lasting Power of Attorneys (LPAs) are highly valuable legal documents, allowing you to elect a trusted individual to act on your behalf in the event that you ever lose capacity and become unable to make decisions for yourself.

When you create an LPA, you become known as the “donor”, and appoint an “attorney” to make certain decisions for you. You can have a single attorney, or choose multiple people to be attorneys who all have a right to contribute to decisions.

For a financial LPA, you can choose whether your attorney will have authority immediately, or only if and when you lose mental capacity.

This document must then be registered with the Office of the Public Guardian (OPG) for the attorney to be able to use this authority.

You may be considering putting an LPA in place for yourself, or it could be for your spouse or civil partner. However, while many people know of or have LPAs, there are some common pitfalls that are easy to trip into when putting them in place.

So, read about four of these pitfalls to help you avoid them as far as possible.

1. Leaving it too late to create one

An LPA is most often used when the donor has lost mental capacity and someone needs to make decisions for them. However, this also means that leaving it too late to create one can make it impossible to put in place at all.

For example, if you were to have an accident that left you unresponsive or in a coma, it would not be possible to elect an attorney after the fact.

You may also struggle to create an LPA in the event that you had a long-term condition that affects your cognitive abilities, such as dementia.

In this case, it would need to be proven that you had the ability to understand a decision, weigh up your options, decide for yourself, and independently communicate your choice.

If you don’t put an LPA in place before you lose capacity and your family need to make decisions for you, they’ll have to go to the Court of Protection and apply for a “deputyship”. This is typically a longer – and more expensive – process.

As a result, it’s important to create an LPA before events like these come to pass.

2. Having the wrong type for your needs

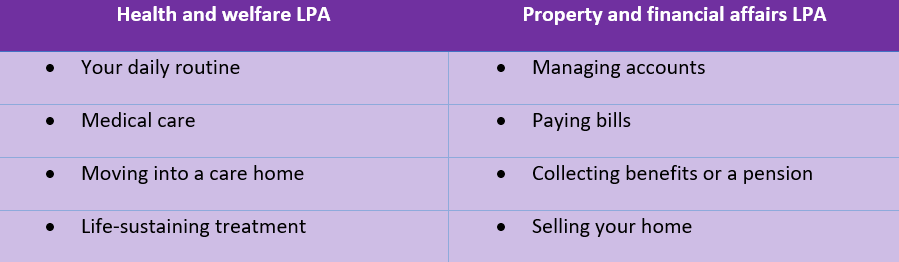

There are two types of LPA that you can put in place:

- Health and welfare LPA

- Property and financial affairs LPA

The table below details the main areas your attorney can make decisions over, depending on the type of LPA you’ve put in place:

You can either choose the LPA that is most relevant to you and your circumstances, or put both in place to give you peace of mind that your attorney will be able to make decisions over all aspects of your health and finances.

However, a common error that many individuals make is having the wrong LPA in place when they come to use it – for example, their attorneys might go to withdraw money from a bank or building society and be told they can’t, as they only have a health and welfare LPA.

Practically, the simplest way to avoid this is to put both in place. If you’d prefer not to do this for any reason, make sure your attorney understands what kind you have, and what this will allow them to do.

3. Forgetting to register the LPA with banks and other institutions

For an attorney to make use of either type of LPA, it must first be registered with the OPG. Furthermore, some financial providers, such as certain banks, building societies, or other institutions you hold money with, may also require you to register independently with them, too, before they’ll allow your attorneys to access your wealth.

So, consider registering your LPA with all your financial providers at the same time as when the OPG confirms it to be in place. That way, there will be no delay in your attorney being able to make financial decisions on your behalf.

4. Excluding details for discretionary fund management

Beyond banks and building societies, you may also want to include instructions for discretionary fund management.

As part of a property and financial affairs LPA, you can give your attorney the right to employ a discretionary fund manager to invest your money, or to continue the scheme if you already had funds under management.

Previously, the OPG did suggest including boilerplate wording to ensure that discretionary fund management was covered in the LPA.

However, since then, the guidance on the government website indicates that you should consider taking legal advice if you want to make specific provision for this in your LPA.

Either way, it is possible for your attorneys to be able to do this. So, you may want to seek legal advice and potentially include instructions in your LPA to ensure they’ll be able to make decisions over your invested money as you wish.

Get in touch

Want to find out more about planning for the future? We can help at Rosebridge.

Email enquiries@rosebridgeltd.com or call 01204 300010 today for more information.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production