Keeping your tax bill to a minimum is a high priority as a business owner. It’s vital to make sure that you’re making the most of every pound your enterprise generates, and that includes being as tax-efficient as possible.

However, with a number of new “stealth taxes”, this task may be more difficult in this tax year than last.

Stealth taxes refer to changes in tax rules and regulations that mean your tax bill increases, despite tax rates themselves remaining static.

As a result of freezes to thresholds and reductions to allowances and exemptions, there are various stealth taxes that could affect your wealth, especially as a business owner.

Read on to discover four, as well as a few ways you may be able to reduce their impact on your finances.

1. Frozen Income Tax thresholds

A significant change that could affect you is the freezing of the Income Tax thresholds at their current levels until April 2028.

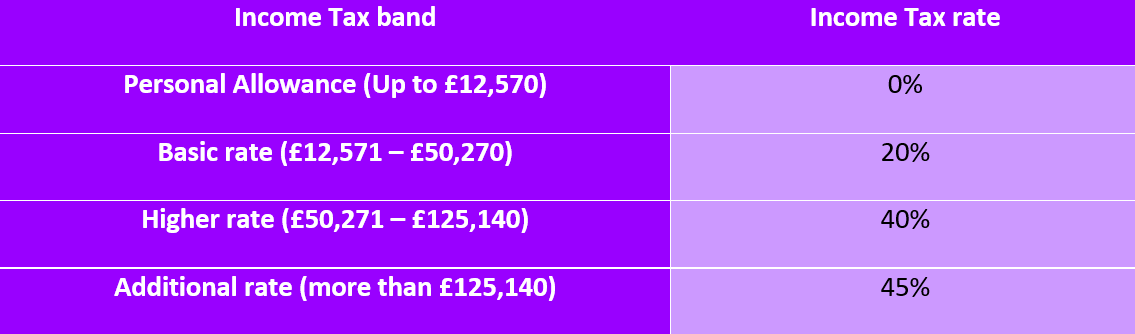

The table below shows you the current Income Tax bands, where they have currently been frozen:

According to Institute for Fiscal Studies figures reported by the Guardian, 1 in 5 taxpayers will pay Income Tax at a rate of 40% or above by 2027.

According to Institute for Fiscal Studies figures reported by the Guardian, 1 in 5 taxpayers will pay Income Tax at a rate of 40% or above by 2027.

For you as a business owner, you may try to limit how much you take as income to remain in a lower tax band. As a result, you have greater control over whether you end up sliding into a higher tax band.

That said, as costs of goods and services increase over time, you may find that you need to draw more income from your business to afford the same standard of living. If you do end up doing this between now and 2028, you may find yourself paying more Income Tax.

To offset this, you could consider increasing your pension contributions. You’ll receive tax relief at your marginal rate of Income Tax, so making pension contributions and making the most of a higher rate could reduce the effect that this stealth tax can have.

2. Dividend Allowance reduction

While dividends have historically been a way for business owners to tax-efficiently take money from their companies, a reduction to the Dividend Allowance could mean that this method isn’t as effective as it was previously.

This is a tax-free threshold that allows you to earn dividends before Dividend Tax is due. In 2022/23, this was £2,000, but has now fallen to £1,000 in 2023/24. It’s also set to fall to £500 in April 2024.

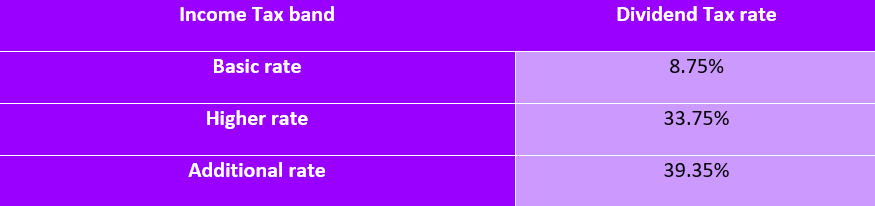

As a result, you’ll now have to pay Dividend Tax on an additional £1,000 of dividend income. Your rate of Dividend Tax will depend on which Income Tax band the dividend income falls into when added on top of your other income. The table below shows the rates of tax you’ll face in 2023/24:

While a reduction in the Dividend Allowance may increase your tax bill this year, dividends can still be an effective method of withdrawing money from your company. That’s because Dividend Tax rates can be more competitive compared to paying the top rates of Income Tax.

Top rates of Income Tax are 40% and 45%, while the equivalent top rates of Dividend Tax are 33.75% and 39.35%.

So, while you’ll lose £1,000 of your tax-free allowance this year and a further £500 next tax year, it may still be preferable to include dividends in your strategy.

3. Capital Gains Tax exempt amount has been reduced

If any of your “income” is formed from liquidating investments, you may be affected by the reduction of the Capital Gains Tax (CGT) exempt amount.

The CGT exempt amount is a threshold for how much you can generate from capital gains before tax is due. It was reduced from £12,300 to £6,000 in April 2023, and is set to fall again to £3,000 in April 2024.

CGT is only charged on any gains you’ve generated on certain assets. So, for example, if you bought shares outside of an ISA for £10,000 and sold them for £25,000, the potentially taxable gain would be the £15,000 increase in value.

Using this example, you can see how the reduction of the exempt amount could affect you. Previously, you’d have been able to use your £12,300 exemption on that £15,000 gain, meaning only £2,700 would be potentially subject to CGT.

However, now that this exemption is £6,000, you may have to pay tax on £9,000 of the gain. From April 2024 when the exempt amount is set to fall to £3,000, this would then be £12,000.

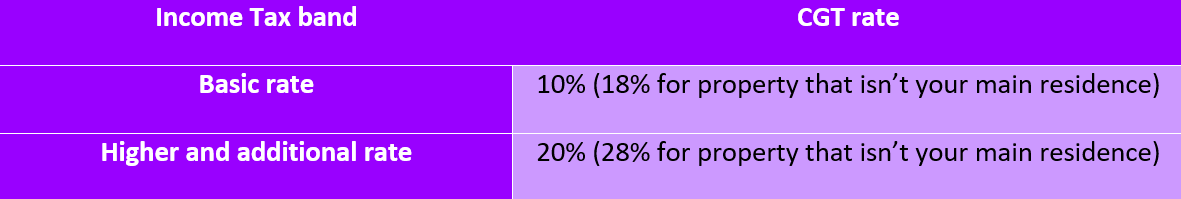

The rate of CGT you’ll pay depends on the Income Tax band(s) that the taxable gain falls into when added on top of your income, as shown in the table below:

To prevent CGT from eating into your gains, you may want to consider holding assets in an ISA, as any gains generated within the ISA wrapper are entirely free from Income Tax and CGT.

You may also be able to offset “allowable losses” against your gains. So, keeping accurate records of losses may help you manage your CGT liability.

4. Frozen Inheritance Tax thresholds

Charged at 40% as standard, Inheritance Tax (IHT) comes into effect on your death when your estate is passed to your beneficiaries.

There are two key thresholds that allow you to pass on a portion of your estate tax-free. These are the:

- Nil-rate band – this stands at £325,000 in 2023/24, and counts towards the total value of your estate

- Residence nil-rate band – this stands at £175,000 in 2023/24, and comes into effect if you pass your main residence to your direct descendants.

In total, that means you can pass on up to £500,000 tax-free, or £1 million as a couple.

However, the nil-rate band has been fixed at this level since 2009, and these thresholds have both been frozen until April 2028.

So, as asset and property values rise over time, a greater proportion of your estate could grow to exceed the nil-rate bands. That means your beneficiaries could face a greater IHT bill when you pass away.

There are various ways you may be able to manage your wealth to reduce the amount of IHT your beneficiaries will face. This can include:

- Making gifts in your lifetime to reduce the value of your estate

- Including charitable donations in your will

- Placing assets in trust, provided that you meet certain criteria.

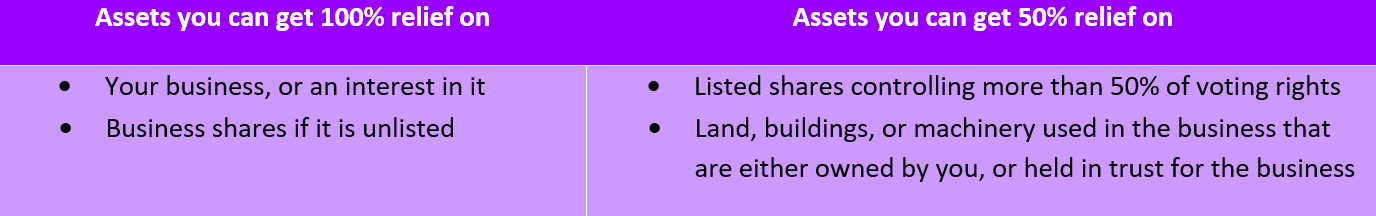

As a business owner, you may also be able to make use of Business Relief, reducing the value of your company and its assets for IHT purposes. This can be either 50% or 100% relief depending on the assets involved, as shown in the table below:

There are a few other restrictions that may prevent you from using Business Relief. It may be sensible to take advice if you’re unsure whether this is an option for you.

IHT can be especially complex, and making mistakes can be costly – indeed, you can also read our other blog we’ve published this month about how trying to mitigate your IHT bill without professional advice can be damaging, and how we can help.

Get in touch

Want to find out how you can reduce your tax bill this year as a business owner? We can help.

Email enquiries@rosebridgeltd.com or call 01204 300010 to find out more.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production