An increase in National Insurance contributions (NICs) and the freezing of some existing tax allowances could result in the amount of tax you pay rising steeply in 2022/23.

Read on to discover how you could be affected by the changes, and to find out about some steps you could take to help reduce your tax bill.

A series of personal tax allowances have been frozen

In his 2021 spring Budget, the chancellor announced a freeze on several tax allowances until April 2026. These changes were primarily driven by the cost of the pandemic, which has knocked the government’s financial plans off course.

Rising inflation, reducing the purchasing power of your money, could have the effect of accentuating the negative impact that these changes might have on your personal finances and financial plans.

The allowances frozen by the chancellor include:

- The Lifetime Allowance (LTA), the maximum you can build up tax-efficiently in your pension fund, has been frozen at the 2020/21 figure of £1,073,100.

- The Capital Gains Tax (CGT) annual exemption has been frozen at £12,300. This is the figure at which you’ll start paying CGT on the profit from the disposal of non-ISA assets.

- The Income Tax Personal Allowance and the higher-rate threshold have been frozen at the 2021/22 figures of £12,570 and £50,270, respectively.

In combination, these frozen allowances could see you owe more in tax in 2022/23.

National Insurance to increase from April

In September 2021, the prime minister made a high-profile announcement that confirmed an increase in the rate of NICs from April 2022.

The increase, earmarked to initially help the NHS recover from the impact of the pandemic and then to meet the cost of social care provision, will affect both employees and employers.

In each case, the applicable NICs rate will rise by 1.25 percentage points. So, for example, from April the main employee rate of NICs will rise from 12% to 13.25%.

Clearly the impending changes could have a detrimental effect on your finances.

To mitigate the impact, here are five ways you could reduce the amount of tax you pay to potentially offset the increase elsewhere.

1. Claim your higher- and additional-rate tax relief

If you pay Income Tax at higher or additional rates, then you can claim tax relief on your pension contributions at the same rate(s), insofar as the gross contributions are matched by income taxed at those rates.

Basic-rate relief is normally applied immediately – so for every £80 you contribute, HMRC will automatically top this up by £20.

But, further relief needs to be claimed back through your self-assessment tax return each year. Higher-rate taxpayers can claim an additional 20% relief, while additional-rate taxpayers can claim an additional 25% relief in respect of contributions matched by income taxed at those rates.

This is not only the case with any pension arrangements you set up yourself, but also many defined contribution (DC) employer-sponsored schemes.

Indeed, according to research published in the Telegraph, 8 in 10 higher-rate taxpayers aren’t claiming this extra tax relief. In total, this adds up to a remarkable £810 million of unclaimed relief on these pensions every year.

If you are claiming additional tax relief, it can be sensible to do it early in the new tax year following the year you’re claiming for. The sooner you get it, the sooner you can invest it and it can start working harder for you.

Please note: if you are a member of an occupational scheme where your contributions are deducted before tax is worked out, or any type of scheme where your contributions are made through salary sacrifice or salary exchange, you will automatically receive all of your tax relief without having to claim back the higher rates of relief.

2. Ensure you take pension income tax-efficiently

You should also aim to keep the amount of Income Tax you pay on retirement income you take from your pension funds to a minimum.

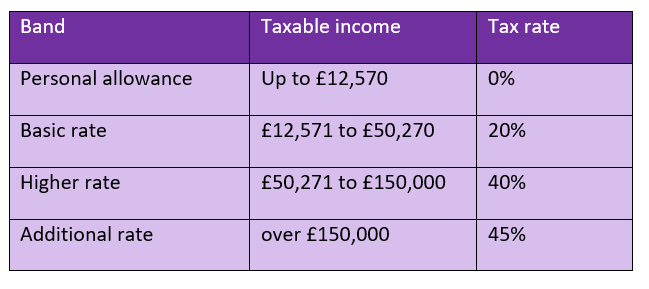

Always be aware of the relevant tax bands and the rate of tax you’ll pay on pension income.

The table below shows the current rates of Income Tax payable as of March 2022. These rates will also apply in the 2022/23 tax year.

Source: HMRC

If both you and your spouse or partner have pension funds you can draw from, it makes sense to think strategically about the total combined income you draw from your respective funds and ensure you’re using the full personal and basic-rate allowances.

For example, if you have no other sources of income, you could conceivably take a combined tax-free income of more than £25,000. Likewise, you could take a joint income of £100,540 on which the maximum Income Tax you’ll pay is 20%.

3. Maximise your CGT allowances

Even though the level is frozen until 2026, each individual still has a CGT allowance of £12,300, again regardless of earnings or assets. That means you can dispose of assets and make gains up to £12,300 before any CGT is due.

Remember that it’s usually possible to transfer assets such as shares and other investments to your spouse or civil partner without CGT being applied.

So, again, think strategically if you’re planning to dispose of assets. Always make sure you’re utilising your full, combined, annual CGT allowance of £24,600.

Beyond that, you’ll pay CGT of 10% (18% for residential property other than your main residence) if the gain falls in the basic-rate band after being added on top of your income.

Any gains, or parts of gains, falling above the basic-rate band when added to income are taxed at 20% (28% for residential property other than your main residence).

Ensure you’re maximising your CGT allowance as far as possible to avoid having to pay these rates of tax.

5. Maximise your pension contributions by using carry forward

The pension Annual Allowance sets the maximum you, and others on your behalf such as an employer, can contribute tax-efficiently across all your pensions each tax year.

Since 2016, this is £40,000 for most people. Higher earners may have a lower Annual Allowance and the figure is restricted if you have flexibly accessed a pension plan. If the Annual Allowance is exceeded, you will suffer a tax charge on the excess.

Even so, you may be able to carry forward unused pension allowances from the three previous tax years if you have a lump sum or higher regular contributions you wish to add to your pot.

That means, in the 2021/22 tax year, you can make pension contributions using any remaining Annual Allowance from the 2018/19 tax year onwards.

Do bear in mind that your own contributions (not employer) shouldn’t exceed 100% of your earnings, or £3,600 if more, as personal tax relief is only available on contributions within this limit.

Remember: you’ll get immediate basic-rate tax relief on your contribution. Furthermore, if you’re a higher- or additional-rate taxpayer, you can claim tax relief at your marginal rate through your self-assessment tax return or tax code adjustment for higher-rate relief.

There are a few rules to meet if you intend to use pension carry forward, which can make it quite complex. Make sure you take financial advice if you want to carry forward your Annual Allowance.

6. Check your payslip and other financial paperwork

If you’re not in the habit of checking your financial paperwork, now is a good time to start. You don’t have to forensically examine everything, but you should be aware of how much you earn, and how much tax you pay.

A good starting point, if you’re employed, is to take a look at your payslip and check your tax code. This will be used by your employer to work out how much Income Tax they deduct from your salary each month. If your code is wrong, you may well be paying too much tax and could be entitled to a refund.

You can check your tax code online for the current tax year and the previous year. You can also ensure that all your details held by HMRC are correct.

Get in touch

If you want constructive advice regarding your tax planning, we can help.

Email enquiries@rosebridgeltd.com or call 01204 300010 to find out more about how we could help you.

Please note:

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production