In November 2021, the Office of National Statistics (ONS) confirmed that the UK Consumer Price Index (CPI) inflation rate had reached 4.2% – the highest rate for 10 years.

Financial analysts at the Bank of England have predicted that it will break through the 5% barrier, for the first time in 30 years, in 2022.

The Bank of England report that the main drivers for the rapid rise in inflation are:

- Rising fuels costs due to an increase in the price cap

- Supply chain issues affecting business costs

- Domestic and global cost pressures.

While it’s highly unlikely that we’ll see inflation surge to 1970s levels, even a rate of 5% could still have an impact on your personal finances, especially given the historic low rates enjoyed in the recent past.

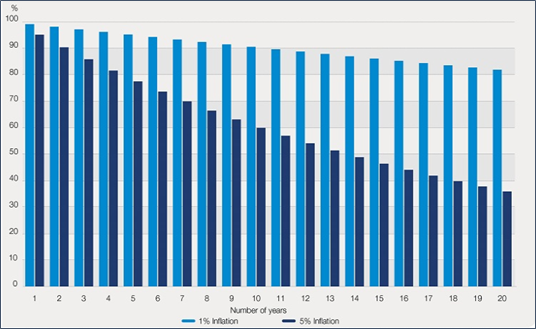

Inflation reduces the buying power of your money. So, an inflation rate of 5% means £100 one year will only buy £95 worth of goods the following year. As you can see from the chart, it doesn’t take long for high inflation to seriously affect the real value of your money.

Source: Schroders

So, it’s crucial to gear your investment strategy to mitigate the impact of inflation as far as possible.

Here are six practical tips to help you manage your investment portfolio during a period of higher-than-average inflation.

1. Keep as little in cash as you can

As you’ve already seen, inflation erodes the real value of your money. This will particularly affect the buying power of any money in your portfolio that is earning a return lower than the rate of inflation – such as traditional savings accounts.

The historic low rates of interest we’re currently seeing mean that you should consider holding as little cash as possible.

This does not apply to any money you have allocated in an emergency fund, as this needs to remain easily accessible and so does not lend itself to long-term investment.

2. Consider taking on more investment risk

One of the keys to developing an effective investment strategy is understanding the balance of risk and reward.

The more risk you accept when you’re investing, the more chance you have of increased returns. But, against that, by taking on more risk you’re increasing the chances of fluctuation in the value of your holdings.

Most investment portfolios will hold a balance of equities and low-risk options such as bonds and gilts. The higher the proportion of equities, the greater the potential investment growth.

So, you may want to consider increasing your equity exposure – even if it’s just in the short term – to give your investment holdings a better long-term chance of outperforming inflation.

3. Remember some sectors perform better than others when inflation is high

Some sectors, such as infrastructure and property, are more resilient to inflation than others.

Likewise, consumer goods suppliers have more flexibility built into their pricing and so can generally ride out rising inflation more easily.

Gold, commodities, property, and index-linked securities can all offer an element of portfolio protection in a more inflationary environment. But none of them provide a perfect inflation hedge.

4. Increase your pension contributions

While inflation is high, it can help to maximise your contributions into your pension fund to offset any potential long-term impact inflation may have. The tax relief provided by the government makes pensions a very attractive savings option, with the basic-rate relief at source meaning that you see an immediate 25% growth on your contribution on day one – without you having to do anything!

As salary increases are often linked to the CPI, it’s likely that – if you’re still working – your earnings could well keep pace with inflation.

This will mean that, if you’re a member of a pension scheme run by your employer, your pension contributions will automatically increase.

If you have a private pension arrangement, you’ll need to increase any regular contribution as and when your earnings go up yourself.

5. Make the most of dividends

The dividends paid out by many blue-chip stocks are a useful hedge against inflation.

Dividend yields aren’t necessarily linked to the performance of company shares, even if their stock value falls. Companies pay dividends on each share, rather than as a percentage of the share value.

So, they can provide a source of growth in your portfolio, especially if you ensure they are always automatically reinvested into the purchase of new shares.

This means you’ll get the benefit of dividend compounding – effectively “growth-on-growth”.

6. Don’t panic! Always think long term

Since it launched in 1984, the FTSE100 has produced an annualised rate of return of 6.8% – assuming reinvestment of dividends.

When you consider the turmoil and upheaval over that period – including periods of relatively high inflation, the dot-com crash, and the 2008 global financial crisis – that’s a remarkably high figure.

So, the key tip we can give you if we do suffer an extended period of inflation is not to panic.

The Bank of England are already under pressure to increase the bank base rate to start driving inflation back down towards the Treasury’s 2% target. It’s likely that these will be slow increments – because rising interest rates will create their own problems – but, over time, the chances are that they will have an impact on inflation.

Get in touch

If you’d like to talk to us about how inflation could impact on your investments, and the steps you should take, please get in touch.

You can email us at enquiries@rosebridgeltd.com or call 01204 300010.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production