On 3 August 2023, the Bank of England (BoE) raised the base interest rate from 5% to 5.25%, a level last seen 15 years ago, in February 2008.

This is the 14th time in a row that the BoE has raised the base rate. The fact that it wasn’t as steep as the 0.5% rise made in June indicates that the consecutive rate rises are starting to have the desired effect on inflation.

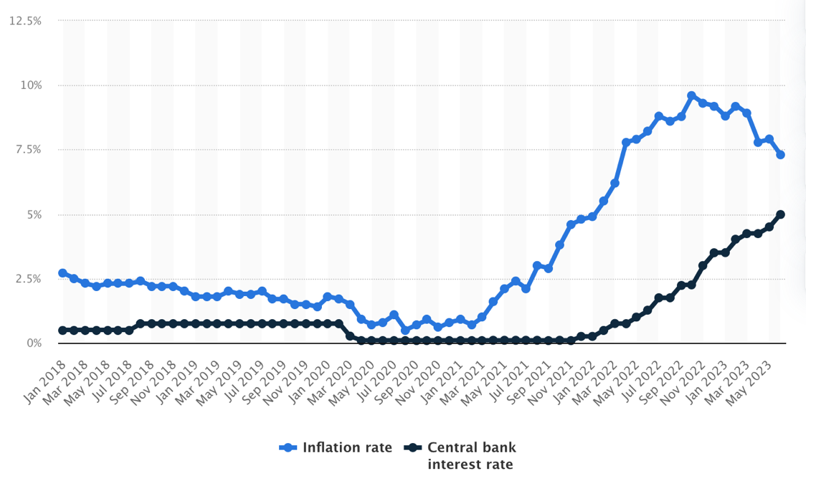

This is illustrated in the chart below, which tracks inflation and interest rates from January 2018 to May 2023. The blue line represents the level of inflation:

Source: Statista

Make sure you’re benefiting from rising interest rates

Now that the base rate has climbed to 5.25%, it’s worth checking how much your cash savings are earning.

Many savers simply stick with the account they’ve been using for years. In fact, research reported by Wales Online revealed that half of UK adults have never changed their savings provider.

Yet, thanks to increasing interest rates, the same report suggested switching from one high street bank’s easy access account to a better offer could earn you £319 more interest over the course of a year.

With this in mind, it’s well worth checking how much interest you’re earning on your savings. If it’s substantially less than the current base rate, you may want to shop around for a better deal.

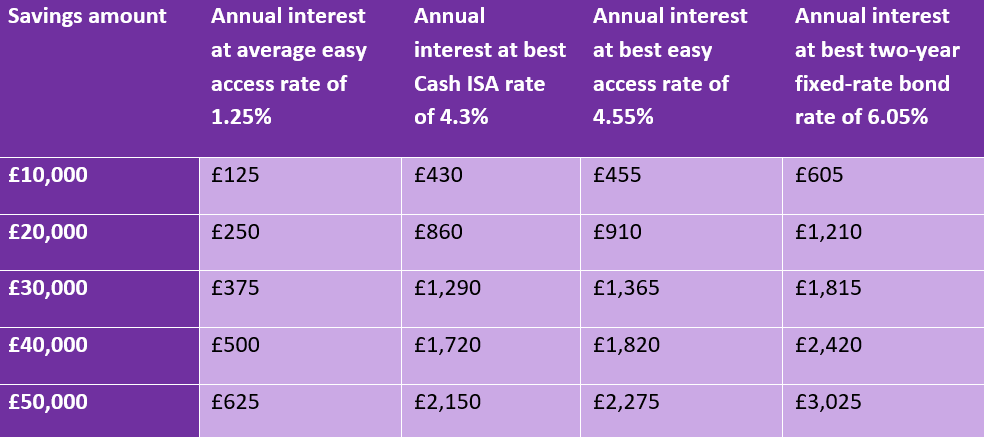

The table below shows the level of annual interest you can expect to earn on different levels of savings, comparing the current average rate on a high street easy access account (1.25%) to the best paying:

- Cash ISA rate of 4.3%

- Easy access account of 4.55%

- Two-year fixed-rate bond of 6.05%.

All of these rates were reported as “best buys” by Moneyfacts on 1 August 2023:

Considering the figures above, switching even a small amount of savings could see you generate hundreds of pounds in additional interest each year.

Shopping around for a better deal could pay off. Indeed, transferring £50,000 of savings from the average easy access account to the best-paying account could earn you more than £1,600 in additional interest.

Watch out for potential Income Tax charges on cash savings

Now that the base rate has climbed to 5.25%, it’s likely that your cash savings are earning substantially more in interest than they were a year ago. If you have a lot of cash in the bank, this uptick could increase the chance of you incurring an unwelcome tax charge.

Fortunately, everyone has a Personal Savings Allowance (PSA) that allows you to earn interest before having to pay Income Tax.

In the 2023/24 tax year, the PSA is:

- £1,000 for basic-rate (20%) taxpayers

- £500 for higher-rate (40%) taxpayers

- £0 for additional-rate (45%) taxpayers.

However, based on the table above, if you’re a higher-rate taxpayer you’d only need around £11,100 in the most competitive easy access account to find yourself exceeding your PSA and paying tax on interest earned.

The PSA covers interest you earn from:

- Bank accounts

- Building societies

- Savings accounts

- Credit union accounts

- Corporate bonds

- Unit trusts, investment trusts, and OEICs (interest-paying)

- Government bonds and gilts.

If you have savings in many different places, the total interest you earn across your cash holdings will determine whether you’ll face a tax charge.

With interest rates at the highest level we’ve seen in 15 years, it’s now much more likely that you will end up paying tax on your savings interest. This is especially true if you’re a higher- or additional-rate taxpayer.

An ISA could help you shield your savings from tax

Making the most of your ISA allowance could help you protect your savings from tax.

In 2023/24, you can save up to £20,000 in the range of ISAs available, or up to £40,000 as a couple. You could use your allowance to open a Cash ISA, allowing you to generate interest entirely free from Income Tax.

Alternatively, if you’re saving for the long term, you could use your allowance to invest in equities. A Stocks and Shares ISA is a tax-efficient way to invest, with any growth or returns free from Income Tax, Capital Gains Tax (CGT), and Dividend Tax.

We can help you ensure that your Stocks and Shares ISA is invested appropriately, taking your long-term goals and appetite for risk into account.

Of course, you could divide your allowance across the two as you see fit.

Over time, using your annual ISA allowance wisely each year can help you to build up a significant sum in tax-efficient savings and help protect your wealth from unnecessary tax charges.

Contributing excess cash to your pension could be an alternate tax-efficient move

If you’ve already maximised your ISA allowance for the current tax year, one alternative may be to contribute more money to your pension.

Another tax-efficient wrapper for your money, saving into your pension means your money has the potential to grow. As with an ISA, any interest or investment returns are free from Income Tax and CGT.

While cash withdrawn from ISAs benefits from being tax-free, with pensions the benefit comes at the point of investing. This is thanks to the tax relief you receive on your contributions.

You can receive tax relief at your marginal rate of Income Tax on your own contributions to your pot up to the pension Annual Allowance each tax year.

If total contributions from all sources (including from your employer) exceed your Annual Allowance, a tax charge will apply to the excess of the pension Annual Allowance in each tax year.

The Annual Allowance threshold for the 2023/24 tax year for most people is the lower of £60,000 or 100% of your earnings – very high earners or those who have flexibly accessed a pension will have a lower figure, and those able to carry forward unused Annual Allowance from previous tax years will have a higher figure.

Of course, you could contribute more than your Annual Allowance, but anything exceeding the Annual Allowance won’t gain the advantage of tax relief and will be subject to a tax charge (either payable by you or possibly payable out of your pension plan).

If you’re married, make sure you plan your finances as a couple

If you or your spouse have an income of less than £17,570, you may be able to make use of the “starting rate for savings”, which can be particularly beneficial for couples where one of you is not working.

The starting rate for savings means that you may be able to earn up to £5,000 in interest before Income Tax becomes due.

If you have income below the Personal Allowance – the threshold before Income Tax is payable – of £12,570, you’ll be eligible to receive the full £5,000 starting rate for savings.

Then, for every £1 of income that you earn over the Personal Allowance will reduce your starting rate for savings by £1.

If you or your spouse are able to make use of the basic-rate PSA and the full starting rate for savings, you may be able to earn up to £6,000 in interest before tax is due.

Get in touch

To find out how we can help you make the most of your cash savings and ensure you’re optimising all the available tax-efficient opportunities, please get in touch.

Email enquiries@rosebridgeltd.com or call 01204 300010.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

The Financial Conduct Authority does not regulate tax advice.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production