Now that the dust has started to settle from the landslide victory that installed the first Labour government in nearly 15 years, your attention might be turning to the tax changes that the new administration could introduce.

Keir Starmer’s government have committed to not increasing the tax burden in areas such as:

- Income Tax

- National Insurance contributions (NICs)

- Value Added Tax (VAT)

- Corporation Tax

Alongside not making increases to these taxes, Labour also aims to avoid increasing debt by the end of the forecast period.

However, Labour also have ambitious goals, as the Institute for Fiscal Studies (IFS) explains. The party has diagnosed a range of issues such as child poverty, homelessness, higher education funding, adults social care, pensions, and more.

Yet, there are no clear funding sources to tackle these issues. In fact, the IFS notes that the current forecasts and plans leave “literally no room – within the fiscal rule that Labour has signed up to – for any more spending than planned by the current government… How they will square the circle in government we do not know.”

So, Labour’s challenge here will be to balance campaign promises with the fiscal constraints they find themselves with. This is where tax could become a key issue.

While Labour have promised not to increase the tax burden on working people, two key areas of taxation that could come under scrutiny are Capital Gains Tax (CGT) and Inheritance Tax (IHT).

As a high-net-worth individual, these two taxes are likely to affect you already. So, any changes to them could increase your tax liability.

Find out why, what changes Labour could introduce, and how you may be able to shield your wealth from tax.

Labour’s first Budget will be a pivotal moment in finding out what could happen

The initial announcement of any changes will likely come in new Chancellor Rachel Reeves’ first Budget, which will be presented to Parliament on October 30th 2024.

After the market uncertainty caused by Liz Truss’ mini-Budget – and the subsequent repealing of those changes – Labour have said they will only carry out one “major fiscal event” a year. The first Budget will likely be that fiscal event, and could contain significant changes that explain how Labour will fund its plans.

With October 30th approaching, there is only one month left to prepare for changes, and Capital Gains Tax (CGT) and Inheritance Tax (IHT) may be high on your priority list.

Capital Gains Tax could be reformed to provide funding for Labour’s plans

While Labour has promised not to increase Income Tax, VAT, or NICs, CGT has had no such mention.

CGT is a tax charged when you generate a capital gain. This is usually on the sale (or “disposal”) of certain assets, which can include:

- Stocks and shares held outside an ISA

- Businesses

- Material possessions, such as art and jewellery

- Inherited properties and second homes.

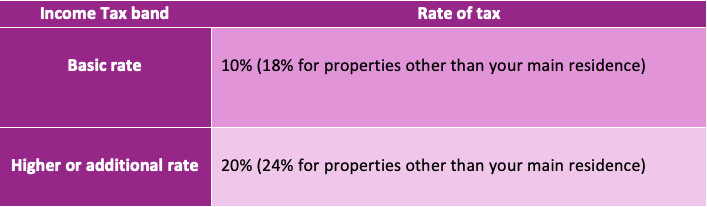

The rate of tax you pay depends on your top rate of Income Tax. The table below details these rates for the 2024/25 tax year:

The Labour manifesto contains no firm suggestion of what changes it might make to CGT. However, with government figures showing that CGT brought in £39 billion in 2023/24, it is understandable why it could be seen as a lucrative way to increase tax revenues.

There are various ways Labour could seek to do this. For example, they might bring the rates of CGT in line with Income Tax directly. Alternatively, they might create a top rate of CGT for additional-rate taxpayers, or reduce how much you can generate in tax-free gains each tax year – see more below.

Regardless of what the changes entail, it is highly possible that CGT will be a target for change in this administration. As a result, you may want to react now and plan ahead to mitigate a potential increase in your CGT liability.

4 ways to reduce your Capital Gains Tax liability

- Make use of your annual exemption and time asset sales strategically

Before CGT is due, you have an Annual Exempt Amount that allows you to generate tax-free gains each tax year. In 2024/25, this stands at £3,000.

You can tactically use this exemption each tax year, liquidating assets up to the threshold without facing a bill. It could be sensible to use your 2024/25 exemption ahead of the new government reducing or removing the threshold.

Similarly, you could seek to time asset sales, looking to sell only when you are in a lower Income Tax band.

- Transfer assets to your spouse

You can usually transfer assets to your spouse without facing CGT. This allows you to use both your annual exemptions, and your spouse may face a lower rate of tax if they are a basic-rate taxpayer while you are in a higher band.

- Invest your wealth tax-efficiently

Certain tax-efficient investments and wrappers can allow you to mitigate CGT. For example, wealth held in ISAs is entirely free from CGT, meaning this could be a sensible place to hold your investments.

- Offset losses

You can offset losses made in the same tax year from your gains. Furthermore, you can deduct unused losses from previous tax years, or carry forward remaining losses to a future tax year.

You can use these losses to reduce your taxable gains, potentially bringing you back under the annual exemption.

Inheritance Tax could be another area that Labour considers

IHT is another key tax that Labour has made no reference to in the manifesto.

Charged at 40% as standard, IHT is a tax that your beneficiaries may have to pay when inheriting your money, property, and assets (collectively known as your “estate”) upon your death.

Before IHT is due, you have a nil-rate band that sees the first portion of your estate passed on tax-free. In 2024/25, this is up to £325,000.

You may also be able to benefit from the additional residence nil-rate band (up to £175,000 in 2024/25) if you pass your main home to your direct descendants.

Bear in mind that your threshold for this may be reduced if your estate exceeds £2 million in value, tapering away entirely if you have total assets of £2.35 million or more.

Both these thresholds are frozen until 2028, which is dragging more and more estates into paying IHT. According to Professional Adviser, IHT receipts reached a record of £7.5 billion in 2023/24, a £4 million increase on the previous tax year.

There are various ways that Labour could seek to increase the government’s IHT take. For one, they might look to extend the nil-rate band freeze beyond 2028, so that rising asset values mean more estates will pay IHT in future. Or, they could even reduce the thresholds themselves, pulling more estates into paying the tax in the shorter term.

Alternatively, they might look to close off currently legal IHT mitigation strategies, such as using offshore trusts. This would align with the party’s broader goal of addressing inequality and could be seen as a way to fund social programs or public investments without impacting day-to-day working incomes.

5 ways you could limit Inheritance Tax on your estate

- Gift assets during your lifetime

By gifting money and assets in your lifetime, you can reduce the size of your estate for IHT purposes. There are various rules and exemptions for gifting with this intention.

In 2024/25, you can gift up to £3,000 under your “annual gifting exemption” and have it automatically fall outside your estate. You can also carry forward unused exemption from the previous tax year.

On top of this, you can theoretically make gifts of up to any value and these will fall outside your estate provided that you outlive the gift for at least seven years. If you do not, these gifts may become liable for IHT. These are known as “potentially exempt transfers”, or “PETs”.

There are various other ways to make tax-efficient gifts. Speak to an adviser to find out more.

- Use trusts

Wealth put into trust by you for a chosen beneficiary can fall outside your estate for IHT purposes. Bear in mind that there may be IHT to pay when putting money in trust, on each 10-year anniversary, and when your beneficiaries come to access the value.

Furthermore, you can place a life insurance policy in trust that your beneficiaries can use the payout from to quickly settle an IHT bill on your death.

- Plan carefully with your pension

As your pensions will typically fall outside the value of your estate for IHT purposes, you may want to consider living on taxable assets in retirement and then leaving your pension to your loved ones.

Your beneficiaries may have to pay Income Tax on inherited pension wealth.

- Explore reliefs and exemptions

As a business owner, you may be able to make use of certain reliefs and exemptions, such as Business Relief or Agricultural Relief, if applicable. These options can confer IHT relief of either 50% or 100%.

- Make charitable donations

Charitable donations left in your will are entirely free from IHT and can help you reduce the size of your taxable estate. Additionally, if you leave at least 10% of your estate to charitable causes in your will, your IHT rate will be reduced to 36%.

We can help you plan at Rosebridge

A new government with different economic priorities to the previous regime could have far-reaching consequences for you and your wealth. Strategic planning is key to successfully managing your finances, so that you can keep your money as tax-efficient as possible.

This is where we can help at Rosebridge. As a team of dedicated Chartered financial planners, we can assist you in creating an effective and tax-efficient strategy for your wealth so that you are always the biggest beneficiary of your hard work.

For example, we can help you organise your wealth tax-efficiently now to help you mitigate CGT on your wealth.

Similarly, we can regularly review your will and IHT position, ensuring that your beneficiaries will inherit as much of your wealth as possible.

If you would like to find out how we can help you, please get in touch today.

Ramsbottom office: Email enquiries@rosebridgeltd.com or call 01204 300010

Chester office: Email enquirieschester@rosebridgeltd.com or call 01244 569141

Leeds office: Email enquiriesleeds@rosebridgeltd.com or call 0113 243 7100

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning, estate planning, will writing, or trusts.

The value of your investments can go down as well as up, so you could get back less than you invested.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production