On 23 September, Kwasi Kwarteng announced one of the largest tax cutting packages in British political history during his short-lived tenure as the chancellor of the Exchequer.

With the backdrop of a looming recession amid raging inflation, the now former chancellor’s “plan for growth” was designed to cut costs for individuals, hoping to kickstart the economy by encouraging discretionary spending.

Some of the most significant measures announced during the mini-Budget included:

- Removing the 45p additional-rate band for Income Tax

- Cutting the basic rate of Income Tax by 1p, from 20p to 19p, from April 2023

- Scrapping the 1.25% National Insurance increase and the subsequent “Health and Social Care Levy”

- Cancelling the planned increase in Corporation Tax, meaning the rate will remain 19% in April 2023

- Cutting Stamp Duty Land Tax (SDLT) rates, with no tax due on the first £250,000 of a home (£450,000 for first-time buyers).

With these measures in place, you may now be expecting to pay a lower amount of tax.

In fact, as a high net worth individual, the scrapping of the additional-rate Income Tax band may have been particularly appealing.

However, after receiving heavy criticism for the decision, the government has now announced that they will not be carrying out many of these changes, including the abolition of the additional-rate band for Income Tax.

So, find out what the reversal of this decision might mean for you, and how you may still be able to save on your Income Tax bill moving forwards.

Removing the band might have saved you thousands of pounds a year in tax

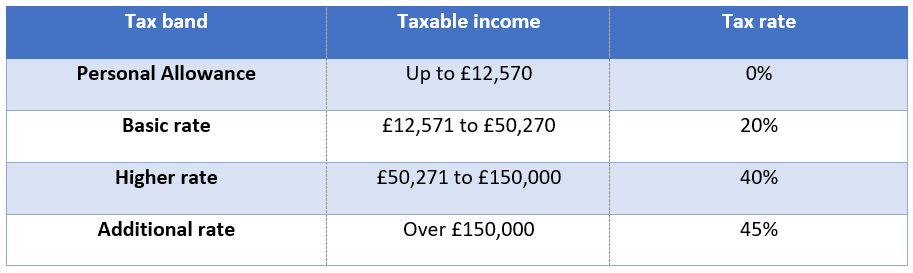

Your rate of Income Tax is determined by your earnings, with each portion of your income subject to varying rates of tax.

The table below details the rates of Income Tax in the 2022/23 tax year:

Under the original plans, the government was going to scrap the additional-rate band for income over £150,000. That would have seen all income over £50,271 be subject to the 40% higher rate of Income Tax.

For an individual with an annual income of £200,000, that would have represented savings of around £2,500 a year.

However, since the government has now reversed this decision, you’ll no longer benefit from these savings in the next tax year. This won’t see you pay more tax than you were already set to, but it does mean your bill will likely not shrink as much as you may have been expecting in 2023.

3 methods that could help you reduce your Income Tax bill

Now that this decision has been overturned, you may be wondering about ways to potentially reduce your Income Tax bill. Here are three methods that could help you to do exactly that.

1. Contribute money to your pension

One way that you could reduce your Income Tax bill is by contributing money to your pension.

Provided that you don’t exceed the pension Annual Allowance (the lower of £40,000 or 100% of your earnings in the 2022/23 tax year) then you’ll receive tax relief on your pension contributions.

This tax relief is paid at your marginal rate of Income Tax, meaning a £100 pension contribution effectively “costs”:

- £80 for basic-rate taxpayers

- £60 for higher-rate taxpayers

- £55 for additional-rate taxpayers.

Basic-rate tax relief is applied automatically, while you normally claim the higher and additional rates through your self-assessment tax return.

Had the additional-rate band been scrapped as planned, you would no longer have benefited from pension tax relief at this rate. The maximum amount of tax relief you would have been able to claim would then have been the higher rate.

But now that it will be remaining in place, that means you can claim £5 more than the higher-rate band for every £100 you pay into your pension.

This money will also have the opportunity to generate returns when it’s invested, either by your scheme provider or by you if you manage your own pension.

So, while you will have to continue paying Income Tax at the additional rate, your pension will continue to be a highly tax-efficient savings vehicle.

Bear in mind that if you’re a high earner, you may be subject to the Tapered Annual Allowance. This can reduce how much you’re able to tax-efficiently save into your pension each tax year.

Make sure you speak to an expert if you think the Tapered Annual Allowance may affect you.

2. Save and invest through ISAs

Next, you could consider saving and investing your money in ISAs.

ISAs are tax-efficient accounts that allow you to either save or invest your money, with any interest or returns generated entirely free from Income Tax and Capital Gains Tax (CGT).

Crucially, your money will be free from Income Tax when you come to withdraw it. This means that you could save into a Cash ISA or invest in a Stocks and Shares ISA throughout your career, and then draw on this money for an income later down the line without having to pay tax on it.

You can save and invest up to the ISA allowance each tax year, standing at £20,000 in 2022/23. So, by building ISA savings or investments over time, you’ll be able to draw a tax-efficient income in later life.

3. Draw dividends from your business

If you’re a business owner, then one possible way for you to reduce an Income Tax bill is to tax-efficiently withdraw money from your company in the form of dividends.

Dividends can be more tax-efficient than taking income directly for two reasons. Firstly, there’s a tax-free threshold called the “Dividend Allowance” before you have to pay tax on your dividends, which sits at £2,000 in the 2022/23 tax year.

Furthermore, your rate of Dividend Tax – which is determined by your Income Tax band – will also be lower than tax on income directly. For example, in 2022/23, the additional rate of Income Tax is 45%. Meanwhile, the Dividend Tax rate for additional-rate taxpayers is 39.35%.

By drawing dividends from your company instead of taking profits as income, you can make use of the tax-free Dividend Allowance, while also paying a lower rate of tax on any dividend income above this amount.

Speak to us

Tax is notoriously complicated so, if you’d like to work with an expert to help you make the most of your money, then please do get in touch with us at Rosebridge today.

Email enquiries@rosebridgeltd.com or call 01204 300010 to find out more.

A note on the current political situation

With the current political uncertainty in the UK right now, everything is changing quickly. So, it’s important to be aware that while the information in this article is accurate at the time of writing, rules and regulations are subject to change by the government and HMRC.

Of course, we’re always on hand at Rosebridge to explain anything that’s going on, offering you valuable reassurance during this period.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority do not regulate tax planning.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production