Over the past couple of years, the UK housing market has reached multiple record-highs. Indeed, the latest data available from the UK House Price Index shows that the average price for a UK home peaked yet again in October 2022 at nearly £296,000.

Additionally, with the Bank of England (BoE) having increased the base rate eight times in 2022, the cost of borrowing for many mortgage products has also increased.

In combination, this could present a difficult situation for any potential first-time buyers you know. You may have children and grandchildren who would like to climb the first rung of the property ladder, but are stuck renting due to the high costs of both property and borrowing.

Yet despite the steep upfront and continuing costs of property ownership, it can still be better for the children and grandchildren in your life to buy rather than rent.

And in fact, you may even be able to help them do this, putting them in a stronger position than if they continued to pay rent to a landlord each month.

So, find out why you may want to encourage your children or grandchildren to buy their own property rather than renting, and how you can also help them become a homeowner.

Mortgage repayments are cheaper than rent on average

Despite high prices and expensive borrowing, mortgage repayments still tend to work out cheaper than rent on average.

It’s true that, in the short term, renting can be cheaper than buying a home. That’s because there are many other fees and charges that come with purchasing property, such as:

- The initial deposit

- Fees for services such as mortgage brokers and house surveys

- Stamp Duty Land Tax (SDLT) if any is chargeable.

Beyond that, there are also the costs of upkeep and any cosmetic changes to make to a property when you buy it.

But, according to Halifax data published by Which?, the average monthly cost that renters pay compared to mortgage holders has been higher for more than the past decade.

According to 2021 data, rental costs grew by 6% to reach £874, while mortgage repayments grew by 2% to just £759. As a result, this would see renters pay £1,400 more each year compared to homeowners.

So, while there may be costs to cover up front, your children and grandchildren could actually save money in the long term by buying a property.

Paying off a mortgage sees them end up with a tangible asset

The other major advantage that mortgage repayments have over rent is that, once the loan is paid off, you own the asset. This means buying gives your children and grandchildren the opportunity to turn their monthly repayments into a solid asset.

If your children or grandchildren choose to rent, that money will only be going to the landlord or company that owns the property, leaving them with nothing.

Meanwhile, if they were to purchase their own property, they would have this to show for it at the end.

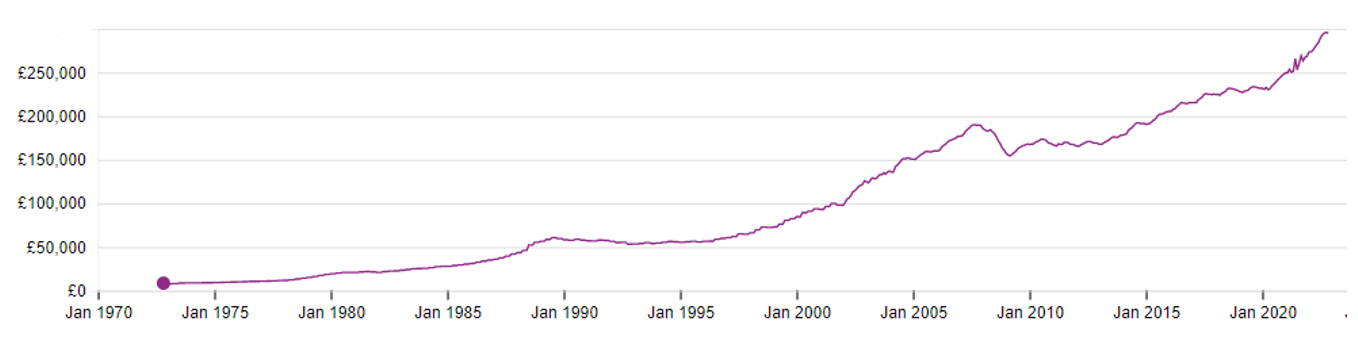

This could also turn out to be a good investment as, historically, property has been an asset that has steadily grown in value over time. The graph below shows how the average UK house price in the UK has changed over the 50 years from November 1972 to November 2022:

Source: Land Registry

This data shows the average price of a property in November 1972 to have been £6,966 which, when adjusted for inflation using the BoE’s inflation calculator, would equate to £75,670 in November 2022. This is quite considerably lower than the average price of £294,910 in November 2022, presenting a notable return on investment.

While past performance does not indicate future performance, this could prove to be a sensible investment over a long time frame for your child or grandchild.

3 ways you could help your children or grandchildren onto the property ladder

While it’s all well and good to explain to your child or grandchild why buying may be a more sensible choice than renting in the long term, this unfortunately doesn’t account for the high costs of property that might prohibit them from being able to invest.

The UK House Price Index measured the average property in England to have cost £315,073 in November 2022 when data was last available. This, according to MoneyAge, would mean first-time buyers need to save for 11 years on average just to afford a deposit.

Fortunately, if you’re in the position to do so, you may be able to help your child or grandchild to get onto the property ladder. Below are three ways that you might be able to do this.

1. Gift them a deposit

The first option you could consider is gifting them a deposit. You can simply give them money as a gift that they can directly use on the deposit for a home.

Your child or grandchild may need you to sign a form with their mortgage lender to confirm that this money is a gift and that you won’t be claiming it back.

Bear in mind that you should only gift money you can afford to give them. Make sure you aren’t compromising on your lifestyle or retirement by doing so.

2. Loan them a deposit

If you want to help your child or grandchild with a cash lump sum but don’t want to just gift them the money, you could choose to loan it to them instead.

In this case, you provide them with the money for a deposit, with a loan agreement in place that details how they will pay this back to you over time.

Bear in mind that great care must be taken if you want to choose this option. The loan agreement will need to include information such as:

- What (if any) interest is to be paid

- When the loan will need to be repaid, such as if they sell the property

- What happens if you need the money back

- What happens if someone involved dies.

If you’re unsure how to create a loan agreement like this, make sure you speak to an expert.

3. Acting as a guarantor

Rather than gifting or loaning money, you could instead act as a guarantor on a guarantor mortgage.

You can act as a guarantor on a portion of or the entire mortgage debt, and this means you agree to be responsible if your child or grandchild is unable to make their repayments. You can later be removed from the mortgage once they’ve proven that they’re able to consistently make these repayments, too.

Again, you must take care if you agree to do this for your child, as you will be legally responsible for the debt if your child or grandchild fails to make their repayments.

Make sure you understand and can afford this responsibility if you choose this option.

Get in touch

If you’d like to find out more about how you could use your wealth to help your children and grandchildren, we can help at Rosebridge.

Email enquiries@rosebridgeltd.com or call 01204 300010 for personalised financial advice.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Think carefully before securing other debts against your home.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production