There’s a good chance you’ve heard the name “Jeff Bezos” before. The famous entrepreneur is widely known for founding the e-commerce giant, Amazon. Before it became a global shopping platform, Bezos initially launched his company in 1994 as an online bookshop.

The company has since grown into the online shopping platform you know today, and you have likely used it at some point in the past.

Like him or loathe him, Jeff Bezos’s rise has been extraordinary, as he went from an online bookshop owner to a world-famous entrepreneur with a net worth of more than $153 billion in the space of just 30 years.

Continue reading to discover three fascinating financial lessons you can learn from one of the most successful businessmen of all time.

1. Always think long term

Bezos originally launched Amazon as an online bookshop in 1994. At the time, he was seemingly struggling to profit from the company. Business Model Analyst states that Bezos only managed to turn a profit through Amazon in 2003, nine years after he founded the company and seven after taking it public.

Yet crucially, he persevered, confident that he could make the business successful. If he didn’t take a long-term view of his company and closed its doors before it became profitable, we likely wouldn’t have the online shopping behemoth today.

It may also be wise to have a long-term plan when it comes to investing. The chart below shows the performance of the FTSE 100 – a stock market index of the 100 largest companies in the UK – between 1985 and 2023:

Source: London Stock Exchange

As you can see, there have been several instances of the index declining significantly in value, namely the:

- Dot-com bubble in the late 90s and early 00s

- 2008 financial crisis

- Covid-19 pandemic.

If you were to solely view market data for these events, you would have a bleak view of market performance. Though, by viewing the index on a long-term, annualised basis, you can see that the general trend has been upward.

This is the reason a long-term approach to investing is prudent. A longer investment term not only means that your assets have more time to grow, but also that they have longer to recover from any significant short-term downturns.

2. Don’t be afraid of taking measured risks

In an interesting interview reported by Business Insider, Bezos said: “When you think about the things you will regret when you’re 80, they’re almost always the things that you did not do. They’re acts of omission. Very rarely are you going to regret something you did that failed and didn’t work.”

It may have been this mindset that encouraged the tycoon to start Amazon. When he was 30, Bezos had a comfortable job with the hedge fund company, D.E. Shaw. Though, he eventually left this role to start his online bookstore as he saw promise in the internet economy, which, in 1994, was still in its infancy.

Much like Bezos took a leap of faith and left his job to start his own business, you shouldn’t be afraid of taking measured risks with your money, either.

This isn’t to say you should leave your current career and start a brand-new company, but it may be worth assuming some degree of financial risk. It’s worth noting that while financial risk often can’t be controlled, you can manage your exposure to it.

For example, if you’re investing and don’t take on any risk whatsoever, there’s a chance your portfolio won’t grow as much as you’d like. It’s important to find a balance based on your appetite for risk and be realistic about what you’re expecting to gain from investing.

By doing so, you may be able to determine the level of risk you need to take to reach your goals and whether you need to adjust your expectations.

In fact, if you accept some financial risk in your life, this could even encourage you to closely assess situations, helping you make far more informed decisions.

3. Try not to panic during periods of uncertainty

It’s hard to deny that the Covid-19 pandemic was a challenging time for companies worldwide. Despite this, Bezos’s company prospered while many others struggled.

Indeed, Sky News states that Amazon reported $108.5 billion in revenue in the first three months of 2021, up 44% from the previous year.

Of course, this was because, being an online shopping and distribution service, Amazon was well-positioned to take advantage of social distancing measures. Regardless, you can still learn from Bezos’s prosperity during a period of financial hardship and how he didn’t panic.

It may be prudent to keep a level head during periods of uncertainty and remember that your chances of losing money when you invest decrease when you hold onto investments for longer.

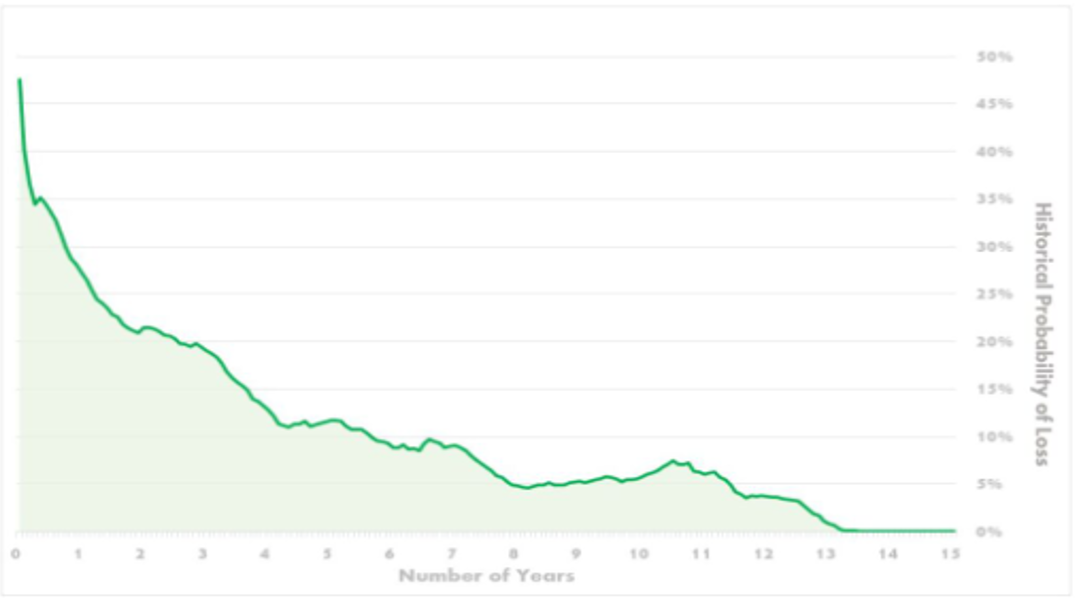

The chart below, using data from developed equity markets between 1971 and 2022, displays the historical probability of loss on any randomly-chosen global stock, depending on how long you hold onto it:

Source: Nutmeg

As you can see, if you held a randomly selected share for a period of over 14 years or more, you could potentially reduce your chances of losing money to virtually zero.

It’s worth remembering that, even during periods of downturn, markets do tend to bounce back eventually. Perhaps surprisingly, some of the market’s largest downturns are often followed by its most significant upswings.

Indeed, data from CNBC shows that the market’s best day was on 13 October 2008, right at the height of the financial crash.

Investments aside, it may be rash to interfere with other aspects of your financial plan during periods of uncertainty.

From maintaining pension contributions to keeping protection cover in place, try to avoid those knee-jerk reactions it can be tempting to make when markets are fluctuating.

Get in touch

While we may not be able to help you found your own multi-million dollar shopping and distribution company, we can help you efficiently manage your finances.

Email enquiries@rosebridgeltd.com or call 01204 300010 to find out how we can help.

Please note

The value of your investments can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production