When you reach retirement, how you manage your wealth becomes arguably even more important. While you will be able to access your pension and other savings you set aside for later life, you will likely no longer be earning a salary or drawing an income from a business.

As a result, it is key to create an effective strategy for your retirement income that ensures you are able to achieve your targets and live your desired lifestyle, with the confidence that you will have enough to do so throughout the course of later life.

Part of being successful to this end is in avoiding making common retirement income mistakes. As financial planners at Rosebridge, we have seen many retirees fall into the same pitfalls and traps. We also helped them to create a plan for their wealth that allows them to reach their goals.

So, read on to discover three common retirement income mistakes that many people make, and how you can avoid them with careful planning.

1. Using your pension tax-free lump sum as soon as you can access it

When you reach age 55 (rising to 57 in 2028), you will be able to start accessing your defined contribution (DC) pension. The first 25% of your fund is tax-free, and the remainder of your pot is taxable. The rate of tax you would face on the rest of your funds depends on your total income in each tax year.

At this stage, many people decide to immediately take some or all of their tax-free lump sum as soon as they can. However, this may not be the most sensible course of action for a couple of reasons.

Firstly, you can spread out your withdrawals, with a portion of each being tax-free while the rest is taxable. Retaining some of your tax-free entitlement can be hugely useful for keeping your income as tax-efficient as possible – find out more in the next section.

Secondly, many people draw their lump sum and then hold it in a savings account. In reality, this money may have been better left in your pension to potentially continue growing in the markets.

Read more: 5 practical ways to make the most of your pension tax-free lump sum

So, before you choose to access it as soon as you are able, it is worth thinking carefully about how you can use your tax-free lump sum to provide you with a sustainable retirement income.

2. Not thinking about how you can make your income tax-efficient

Although you may no longer be working, your retirement income is taxed just as your earned income is throughout your lifetime.

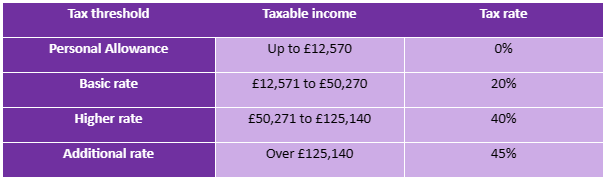

That means, in the 2023/24 tax year, you face Income Tax rates as shown in the table below:

In turn, it is worth thinking about how you can keep your income tax-efficient, so that you can enjoy the money you have saved rather than seeing it taken in tax.

To manage this, you could carefully draw income with these thresholds in mind to help you pay less tax, helping you to stay in the band below and reducing the rate you face.

Furthermore, you could draw a portion of your income from ISAs, as withdrawals from these tax-efficient accounts do not count towards your taxable income. You might also want to consider how you can most suitably use your pension tax-free lump sum, as discussed above.

These are just a few options you could look at making use of. The most appropriate options will depend on your personal circumstances.

As part of this, you may also want to consider Inheritance Tax (IHT) too, because you can make a significant difference to the bill your loved ones may face by carefully considering your retirement income strategy.

For example, your DC pension will typically fall outside the value of your estate for IHT purposes. Meanwhile, money held in savings accounts and ISAs will normally be taxable.

So, by spending your IHT-eligible assets first and retaining your pension for longer, you may be able to pass on more wealth without landing your loved ones with a bill.

While this may not make your retirement income more tax-efficient, it could reduce an IHT bill for your family in future.

3. Forgetting about inflation

The rate of inflation, which measures the increasing cost in the price of goods and services over time, has been a constant topic in the news over the past 18 months or so.

Office for National Statistics (ONS) data shows that the rate of inflation exceeded 10% in every month from September 2022 to March 2023. Meanwhile, the latest ONS data shows that inflation in the 12 months to October 2022 was 4.6%.

This is a concern for retirees because the rising cost of living essentially means that the money you set aside for later life does not have the same spending power it did. For example, this month’s figure means that goods and services are 4.6% more expensive than they were a year ago.

As a result, it is crucial to consider inflation when saving for retirement and planning your income, especially because your retirement could last upwards of 20 years.

Yet, according to FTAdviser, a study of 4,750 UK savers aged 40 and over revealed 51% of them to not have factored inflation into their plans for the future.

Your cash savings, investments, and even your pension funds are not guaranteed to increase in value in line with the cost of living. As such, this puts your wealth at risk of losing its spending power throughout the course of your retirement.

Certain aspects of your wealth may be somewhat protected from inflation. For example, if you have made sufficient National Insurance contributions (NICs) to receive the State Pension, you will see the sum that you receive increase each year.

Meanwhile, if you have a defined benefit (DB) pension or an inflation-linked annuity, you will typically see the amount you receive from these sources increase in value over time, too.

But otherwise, your income could lose its spending power during your retirement. That is why it is crucial to consider inflation and design your retirement income strategy under the assumption that your outgoings could increase over time, even if your lifestyle remains the same.

Get in touch

If you would like to work with an expert who can help design a bespoke retirement income strategy for you, please speak to us at Rosebridge.

Email enquiries@rosebridgeltd.com or call 01204 300010 to get in touch today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production