Given the number of decisions you have to make in your life, it’s inevitable that sometimes you’ll have regrets.

These could apply just as much to something you did, as something you wish you’d done. Ultimately, any regrets are liable to be fleeting, and have minimal long-term impact.

But financial regrets can be more serious. A mistake or a missed opportunity won’t just end up with you having regrets, but could also cost you a substantial amount of money in the long run.

Here are six of the most common financial regrets, and how you can avoid them.

1. Not planning ahead

As with anything, having a plan drawn up for your financial future can make the difference between success and failure.

But it’s remarkable the number of people who leave their finances to chance or believe that a plan is something for the distant future.

A financial plan gives you structure and makes it less likely that you’ll be impacted by unexpected and unwelcome events. It also makes it easier for you to plan for your future and will make sleepless nights worrying about money less likely.

Your plan doesn’t have to be complicated or too detailed. Initially, you can start with very basic information, such as:

- A simple income and expenditure chart

- Details of your savings and pensions

- A note of all your debts, including loans and credit cards.

Just an outline plan can make it less likely that you’ll have any regrets as you go through your financial journey.

2. Not having an emergency fund

Unexpected events can happen and can leave you financially vulnerable if they result in a big bill.

Keeping your fingers crossed and hoping that such events won’t happen to you is no substitute for setting aside a sum of money you can draw on in the event that the unforeseen happens.

Having an emergency fund in place makes it easier to cope with unexpected events – and also gives you the peace of mind that you have the means in place should something happen.

A rough rule of thumb is that your fund should be three times your monthly “take-home” income.

3. Having too much unsecured debt

Struggling to clear credit card or other unsecured loan debt can often lead you to regret not keeping a tighter rein on your borrowing.

It doesn’t help that buying something using a credit card is often far too easy. In the short term it can help satisfy a craving, but it’s liable to leave you with a potential long-term problem if you don’t keep your spending under control.

Interest rates on credit cards can be eye-wateringly high, and the impact of interest compounding at such high rates means it can take ages to clear your debt if you are just paying the minimum amount each month.

For example, according to MoneySavingExpert, if you borrowed £3,000 aged 21 and only made the minimum repayment, you’d be almost 50 years old before you cleared the debt.

Credit card interest rates far outstrip the returns you’re likely to get on investments and savings. So, clearing any existing debt, and then keeping future borrowing to a minimum, should be your number one financial priority.

4. Not saving into a pension sooner

Having considered the negative impact of compounding in the previous section, it’s worth stating that compounding has an upside when it comes to saving money.

It’s such a big upside that Einstein is alleged to have described compounding as “the eighth wonder of the world”.

In simple terms it means “growth-on-growth”. So, if you invest £10,000 and it grows by 5% in a year, the next year’s growth is on £10,500, and so on.

So, delaying saving into a pension – even by just a couple of years – means you’re missing potential compounded growth in future years.

If you haven’t already started saving for your retirement, the best time to do so is now. Otherwise, you could be left regretting years of missed investment growth on your money.

5. Not understanding investment risk earlier

“I wish I’d taken more risk” might sound like an odd regret, but it can be a common one when it comes to how you invest your pension fund.

The balance between investment risk and reward can be a difficult concept to understand. The key thing to bear in mind is that, in the long term, the value of investments should show steady growth – even though, in the short term, fluctuation is inevitable.

The nature of markets is that they go up and down. But you can mitigate investment risk by investing for the long term and reinvesting dividends.

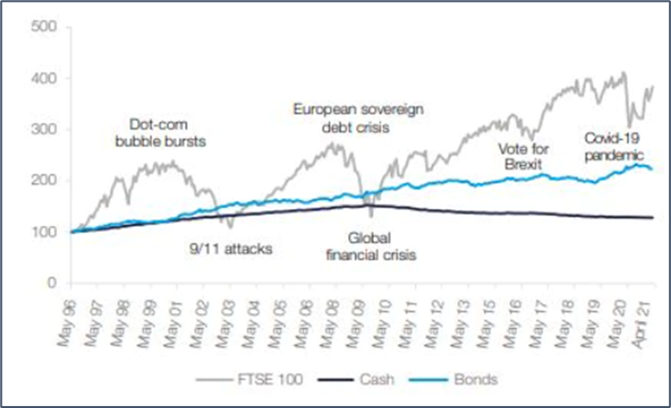

In the last 25 years, there have been some cataclysmic events that have impacted financial markets: the dot-com bubble crash at the start of the 21st century, the global financial crash of 2007/08 and, most recently, the fall caused by the Covid-19 pandemic in March 2020.

But, as you can see from the chart below, after each fall, markets have recovered lost ground and continued to rise:

Source: Brewin Dolphin / Datastream

The other key lesson to take from the chart is that any move to “safer” investment options, such as cash or bonds, would have resulted in you missing out on long-term growth.

6. Underestimating the impact of inflation

We’ve enjoyed remarkably low levels of inflation in the last three decades, compared with the rates it reached in the 70s and 80s. In fact, apart from one single blip in 2011, inflation has stayed below 5% since 1992.

So, it would not be a surprise if you haven’t thought about the impact inflation can have on your savings and spending.

Inflation reduces the value of your money in real terms, and so reduces your spending power.

An annual inflation rate of 5% means that £1,000 becomes worth only £950 in 12 months’ time.

While you’re working, you can offset the impact of this through salary increases, changing jobs and altering your spending habits. But once you’ve retired, not all those options are available.

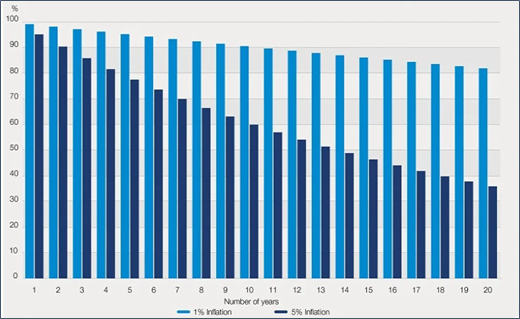

The chart below shows how even an inflation rate of 5% can impact on your finances.

Bank of England UK CPI data (Source: Schroders)

After just 10 years of inflation at 5%, your money would be worth 40% less than it is today.

By understanding the threat inflation can pose to your savings, and therefore your quality of life in retirement, you can structure your investment strategy to mitigate the impact of rising prices.

Get in touch

At Rosebridge, we have a wealth of experience in helping our clients to avoid financial regrets.

If you’d like to know more about the services we can offer or want to talk through any regrets you might currently be having, please get in touch.

Email enquiries@rosebridgeltd.com or call 01204 300010.

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production