Business owners have multiple options at their disposal when choosing how to move on from their companies.

You might be considering searching for a third-party buyer to sell the entire company to. Or, you may have always wanted to keep your business in the family, planning to pass it on to your children in future.

Alternatively, you could consider setting up an Employee Ownership Trust (EOT), essentially passing the business on to your employees.

These arrangements can come with significant benefits for business owners, but can also be complicated and present some notable disadvantages.

So, read on to discover three pros and three cons of EOTs to help you decide whether it would be an appropriate choice for you and your business.

Passing on your business to your employees

An EOT is a form of employee ownership. It is a type of trust that holds a controlling interest in a company for the benefit of the business’s employees, holding company shares on behalf of the employees.

This essentially involves you (and your business partners, if you have any) selling your shares to the trust, with the company becoming employee-run. You can sell all your shares to the EOT, or choose to remain involved with the business and retain a minority stake if you prefer.

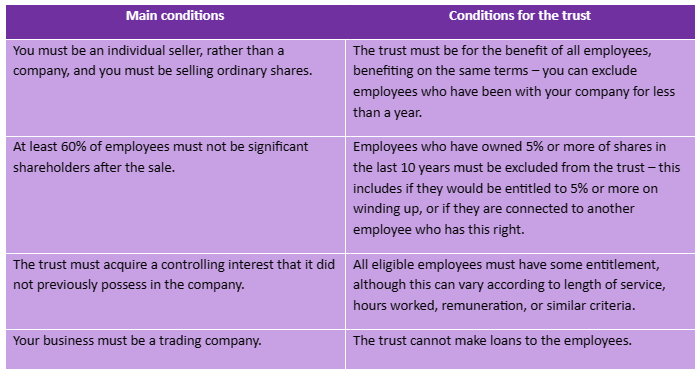

There are certain rules you will need to comply with in order to set up an EOT. The table below shows some of these rules, and criteria that the trust itself must meet:

This list may not be exhaustive, and there might be further criteria you must meet. If you do meet all the requirements, you may be able to pass on all or a portion of your business through an EOT.

3 pros of Employee Ownership Trusts

1. Protect your legacy with a guaranteed sale

One of the major benefits of disposing of your business by passing it to an EOT is that you will not have to deal with a third-party or trade buyer. As a result, there is no risk of a buyer backing out and the deal falling through, leaving you in the lurch.

Additionally, by going down this route, you will receive full market value for your shares. This must be calculated from an independent valuation.

Finally, this presents an opportunity to protect your legacy. You can be confident the business will continue to run in the way you taught your team to do so. You will also have certainty that your employees are protected, which you may not have when you sell to a third party.

2. Tax-efficient benefits for sellers and employees

An EOT can be tax-efficient for both you as the seller, as well as for your employees.

You and any other existing shareholders will pay an effective Capital Gains Tax (CGT) rate of 0% when selling the business. This can present notable savings, especially if the business has significantly risen in value since you started running it.

Meanwhile, employees can receive annual tax-free bonuses of up to £3,600. This gives them a financial incentive to support the creation of an EOT.

3. Improve employee morale and productivity

Another benefit for both you and your employees is an improvement in employee morale and productivity.

Creating an EOT and passing the business to your team provides them with a sense of ownership, and a financial stake in the success of the company. In turn, this may motivate them to work hard and build the business.

Furthermore, this may help staff retention and the business’s ability to attract the best talent.

This method of moving on ensures that your team can continue running the company as you did, working for each other to achieve growth.

3 cons of Employee Ownership Trusts

1. The price of shares may be lower than a third-party sale

While a sale to an EOT is guaranteed, it does mean the price you receive for your shares may be lower than what a third-party buyer is willing to offer.

The independent market valuation may be lower than you expect, and you will not be able to negotiate on it. So, you could end up with less for your shares than you think they are worth.

Furthermore, while a buyer might make an immediate cash payment, you also typically have to wait before you receive the cash for your shares.

That is because the EOT essentially starts with no money. So, unless there is surplus cash on your balance sheet, this will be restricted from day one. You will then receive your money on a deferred basis, usually over a period of years.

This may make an EOT an unsuitable option if you want to retire immediately from the proceeds of a sale.

That said, there is no guarantee there will even be a willing buyer. So, these are hypothetical issues to have.

2. There may be other tax rules to bear in mind

While an EOT is typically a tax-efficient arrangement, there are other taxation concerns to bear in mind:

- If you receive further payments which depend on future company performance, these may be partly taxable when you receive them.

- You will lose the CGT relief on the sale of shares if the trusts sells its controlling interest before the end of the tax year that follows the sale.

- The trust itself will be subject to CGT if it sells its controlling interest, or ceases to trade, after the end of the tax year following the sale.

You need to be aware of all the associated rules before you set up the EOT. Otherwise, you or your employees could face an unexpected tax charge down the line.

3. You will need to seek advice before you set up an EOT

As you can see, setting up an EOT is a complex process, so it is important that you seek legal and accounting assistance.

While this is not necessarily a disadvantage of an EOT itself, it is important to keep in mind that this can be complicated and will take time to arrange. If you want to proceed with an EOT, it is important to approach it with this mindset, so you do not become frustrated with the process.

Get in touch

If you would like to find out how to make the most of your money as a business owner, we can help at Rosebridge, please get in touch today.

Ramsbottom office: Email enquiries@rosebridgeltd.com or call 01204 300010

Chester office: Email enquirieschester@rosebridgeltd.com or call 01244 569141

Leeds office: Email enquiriesleeds@rosebridgeltd.com or call 0113 243 7100

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only. All contents are based on our understanding of HMRC legislation, which is subject to change.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production