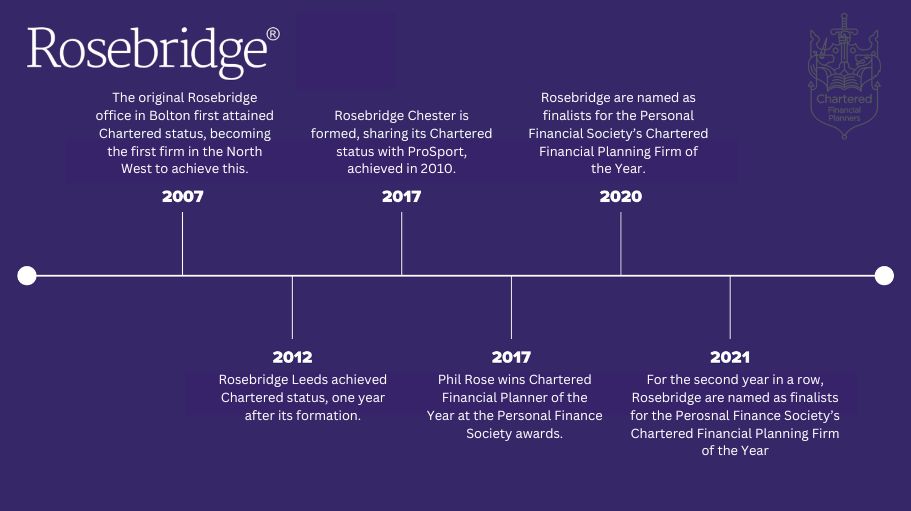

In June, Rosebridge proudly celebrated 17 consecutive years as a Chartered financial planning firm, reflecting our ongoing commitment to excellence. When we first earned Chartered status in 2007, Rosebridge was a small team of just four. Today, 17 years later, we have grown to over 40 employees.

One of the greatest challenges for any growing business is maintaining high-quality customer service. As we expand, it remains essential to deliver the personalised, attentive service our customers have come to expect.

To meet this goal, we focus on developing our team. We have invested in improving our back-office systems, alongside offering internal mentoring and regular training programs that emphasise the company’s founding values and service standards. We foster collaboration across departments through regular meetings, integrated communication, and team-building activities, all under strong leadership, to ensure that every office is aligned with our clients’ goals.

Maintaining our Chartered status while scaling requires a careful balance of technology, culture, and communication. By addressing these challenges head-on, we have grown the business and enabled our team to provide high-quality, tailored advice, without compromising the exceptional client experience that sets us apart.

Chartered status is only awarded to firms that meet strict criteria

Chartered status is usually the terminal qualification for a profession, designating an individual or firm as having achieved the highest possible accolade. The accreditation itself is awarded by an industry body, using strict criteria that the individual or firm must meet.

In the case of financial planning, Chartered status is awarded by the Chartered Insurance Institute (CII). The accreditation is awarded to individuals and firms that have made a public and transparent declaration of a commitment to professional standards and client-centric service.

This revolves around development of staff, serving the best interest of clients, and being actively involved in promoting strong ethics and values in the profession – the latter of these underpinned by a strict Code of Ethics published by the CII.

Chartered status is a hugely important indicator of quality in the financial planning profession. According to CII research:

- 80% of consumers would be more likely to choose a Chartered firm.

- 73% of businesses would be more likely to choose a Chartered firm.

- 88% of consumers who have used a Chartered firm in the past would likely use a Chartered firm in the future.

- 84% of businesses who have used a Chartered firm in the past would likely use a Chartered firm in the future.

For us at Rosebridge, our Chartered status has been incredibly valuable. It has instilled confidence in our many clients that we will always serve their best interests, and acted as proof to other professionals that we are a top firm dedicated to client service that they can trust when recommending our financial planning services.

Both firms and individual planners can achieve Chartered status

There are two types of Chartered status in financial planning: individual, and corporate.

Individual Chartered status

Individual planners can achieve Chartered status. Gaining it is a strenuous, in-depth process, requiring advisers to achieve certain milestones such as passing exams, while also having a certain proven level of experience.

Corporate Chartered status

Just as we have been at Rosebridge, firms can be awarded Chartered status. This requires the entirety of the firm’s board and at least 90% of customer-facing staff to be members of the CII.

Furthermore, 50% of the firm’s advisers must be individually Chartered. All clients must be able to access a full financial planning service with a Chartered financial planner.

Corporate Chartered status revolves around the Chartered ethos, which is made up of three key parts:

- Nurturing knowledge, developing the right expertise and investing in the team to improve standards

- Client centricity, always acting in the best interest of clients

- Serving society, being a good corporate citizen and building trust in the profession.

All this work is on top of that completed by our planners to achieve individual Chartered status.

Corporate Chartered status sets us apart from our peers

There were reported to be more than 16,000 firms authorised to provide regulated financial advice in the UK at the end of 2023. Yet, just 591 of them have achieved corporate Chartered status. This is why it is such a significant achievement for us to have corporate Chartered status at Rosebridge.

Crucially, Chartered status has client-centric practices at its core. So, everyone we work with can have complete confidence in our commitment to both the profession and to upholding the highest of client service standards.

Chartered status is not the only feather in the Rosebridge cap

While Chartered status is no doubt a hugely proud achievement for us at Rosebridge, it is not the only feat that differentiates us from other firms. We also have many other accreditations and accolades that show why our service is a cut above the rest.

Firstly, many of our financial planners are qualified members and Fellows of the Personal Finance Society (PFS), the professional body dedicated to building trust in the financial planning profession.

The fellowship programme in particular is an excellent financial planning achievement and demonstrates a high level of commitment to continued professional development, as it is the highest designation that the PFS offers.

Furthermore, Rosebridge has been widely recognised across our profession as one of the top firms, having made significant progress in and winning many industry awards. This includes being:

- Included in Citywire’s New Model Adviser Top 100 in 2023, our seventh consecutive year in this list of the best in the professional financial planning community

- Finalists in the “Advice Firm of the Year” category at the 2021 Money Marketing Awards

Recognition like this is further evidence of our continued pursuit of the highest standards, and our commitment to continued professional development.

Get in touch

Working with a Chartered financial planner means receiving a knowledgeable, experienced, best-in-class service that is focused on the right outcomes for clients.

If you would like bespoke expert financial and investment advice from our award-winning team of Chartered financial planners, please get in touch today.

Ramsbottom office: Email enquiries@rosebridgeltd.com or call 01204 300010

Chester office: Email enquirieschester@rosebridgeltd.com or call 01244 569141

Leeds office: Email enquiriesleeds@rosebridgeltd.com or call 0113 243 7100

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production