During his autumn statement in November 2022, Jeremy Hunt made a range of significant announcements that will directly affect many UK taxpayers – and certainly business owners – throughout the coming tax years.

Reductions in the Dividend Allowance and the Capital Gains Tax (CGT) exempt amount will come into effect in April 2023, potentially limiting your ability to tax-efficiently draw income from your business and investments.

Meanwhile, an increase to the national minimum wage could also drive up operating costs for your company.

Most notably, the chancellor made two changes that could directly affect how much Income Tax you pay over the coming tax years.

The first of these changes was to lower the additional-rate Income Tax band. Previously, the 45% top tax rate came into effect for those with income exceeding £150,000. However, this threshold will now be lowered to £125,140 in April 2023 which, according to Politics Home, will see 250,000 taxpayers pulled into the top band.

More importantly, the chancellor also confirmed that the Personal Allowance – a tax-free threshold before Income Tax becomes payable – will be frozen for two more years than it already was. This means it will remain at its 2022/23 level of £12,570 until 2028.

This decision has drawn attention to the fact that many earners face a 60% Income Tax rate on a portion of their wealth, with more people to be affected by 2028.

So, find out who this will affect, why it could be the case for you, and what you can do to try and reduce the tax bill you’re facing as a business owner.

2 million people are facing a 60% Income Tax rate by 2028

According to figures published by MoneyAge, 2 million more people are facing a 60% marginal rate of Income Tax by 2028.

The reason for this is to do with your Personal Allowance. In 2022/23, the Personal Allowance stands at £12,570, meaning you don’t pay tax on income before reaching this figure.

However, the Personal Allowance also reduces for high earners, falling by £1 for every £2 their income exceeds £100,000. This means that if you have income of £125,140 – where the additional-rate band will start in April 2023 – or more, then your Personal Allowance will disappear completely.

Consequently, the research in MoneyAge indicates that those with income between £100,000 and £125,140 will effectively be taxed at 60%. Consider this example:

- Your income is £110,000. That means your Personal Allowance reduces by £5,000.

- You’ll pay 40% Income Tax on the portion of your income between £50,271 and £110,000.

- Crucially, as you’ve lost part of your Personal Allowance, you’ll pay 20% basic-rate Income Tax on your earnings between £7,570 and £50,270 – essentially adding 20% extra Income Tax on the £5,000 of your earnings that are no longer covered by the Personal Allowance.

These figures also highlight that, when National Insurance (NI) of 2% is added to this, that means just £38 of every £100 you earn goes into your pocket.

With the Personal Allowance thresholds fixed until 2028, you may find yourself paying more in tax if you take more income from your business to keep up with rising costs and inflation over the next five years, too.

Furthermore, with the reduction in the additional-rate tax band set to come into effect in April 2023, any income you have between £125,140 and £150,000 will also be subject to the 45% additional-rate tax, rather than the 40% higher rate. This could see you pay more in tax than you were before, even if you haven’t drawn any more income from your business.

In light of these changes, you may want to consider methods that reduce your tax liability if you’re set to be affected, ensuring that you continue to be the biggest beneficiary of the hard work you put into your business.

Making additional pension contributions could benefit you and your business

One method that could be useful for you as a business owner to avoid the 60% tax charge is in making additional pension contributions. That’s because not only will you not have to pay Income Tax on the income, but you’ll also receive tax relief at your marginal rate of Income Tax on top.

Consider the example in which your income is £110,000. That means you’ve lost £5,000 of your Personal Allowance, exposing £5,000 of your earnings to the 60% effective tax rate.

But if you instead contributed £10,000 to your pension, your taxable income would be just £100,000, meaning you wouldn’t see your Personal Allowance reduced at all.

And, because it comes from income in the higher-rate tax band, you’ll be able to claim 40% tax relief on it.

Making pension contributions could be particularly useful if you’ve found yourself moved into the top tax band and are now paying 45% Income Tax on part of your income, too.

That’s because you’ll now be able to claim additional-rate tax relief on a portion of your income you contribute to your pension. This will essentially mean that a £100 pension contribution will only “cost” you £55.

You’ll only be able to claim the top rate on income from the additional-rate tax band (i.e., that exceeds £150,000, or £125,140 in 2023/23) and you’ll also need to claim anything above the basic rate through a self-assessment tax return.

Crucially, putting money into your pension as a business owner essentially makes it an employer contribution. As a result, this money is deducted from your total operating profits and won’t be liable for Corporation Tax.

That means making pension contributions could provide multiple tax benefits, in the sense of reducing your total taxable income, increasing the amount of tax relief you can claim, and Corporation Tax savings.

You must bear in mind that employer contributions do still count towards your Annual Allowance, currently standing at the lower of £40,000 or 100% of your earnings in the 2022/23 tax year.

Dividends still present an option to business owners – although the Dividend Allowance will also reduce

Another option that may still remain viable to business owners is withdrawing income from your business in the form of dividends.

In doing so, this allows you to make use of the tax-free Dividend Allowance, standing at £2,000 in 2022/23. That means you’ll be able to take tax-free dividends from your company up to this amount.

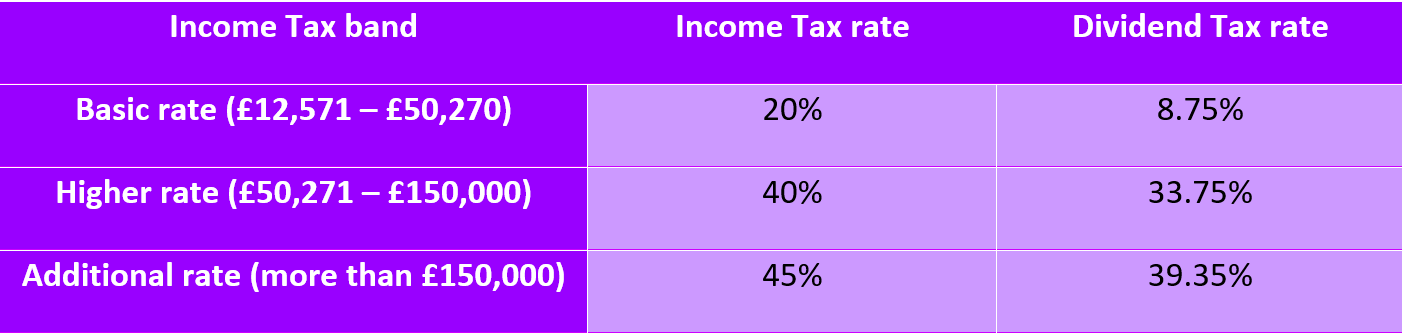

Furthermore, your rate of Dividend Tax, which is determined by the Income Tax band you fall into, will also be lower compared to Income Tax.

The table below shows the Income Tax and Dividend Tax rates in 2022/23:

This lower rate could make dividends a more tax-efficient method of withdrawing money from your company.

However, one issue that might make this option slightly less attractive is that, as mentioned earlier, the chancellor has also reduced the Dividend Allowance, the tax-free threshold that allows you to take dividend income before tax is due.

While the Dividend Allowance stands at £2,000 in 2022/23, this will be reduced on 6 April 2023 to £1,000. This is also set to reduce again to £500 in April 2024.

While this is not a huge change numerically, it will mean that only the first £1,000 of dividends you draw from your company will now be tax-free. Any amount above this will be subject to Dividend Tax depending on which Income Tax band you fall into, as shown in the table above.

Even so, these rates are still lower than what you would pay in Income Tax if you withdrew money from your business as income. As a result, it may still present an option for you to limit how much tax you’ll pay moving forwards.

Speak to us

If you’d like to find out the most effective methods for mitigating how much tax you’ll have to pay, please get in touch with us at Rosebridge.

We’re experts in helping business owners like you to manage their money as effectively as possible.

Email enquiries@rosebridgeltd.com or call 01204 300010 to speak to us today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production