Financial planning is often thought of in individual terms. It can be easy to focus on the pensions, investments, and savings you have built up throughout your career, and then look at how you can use them to achieve your personal goals.

But if you are married, in a civil partnership, or a long-term relationship, it is well worth thinking about planning your wealth as a joint venture.

You have chosen to live your life alongside your spouse or partner, and your wealth is the means by which you can achieve the desired lifestyle you both want. That is why it can be so impactful to plan together as a united front.

Read on to discover how to plan for retired life alongside your spouse and partner, so you can achieve the type of lifestyle you both want.

Try to think of your money collectively, rather than individually

Often, it is easy to think of your wealth as your own. The mindset of “I earned it so I will spend it” can be overarching.

If you feel this way, then you are not alone. Indeed, according to Aviva, 38% of people even have a secret account or “money stashed away” that their partner does not know about.

Yet actually, it can be useful to think of the wealth you and your spouse or partner have as a collective total. Thinking of your money in terms of “ours” rather than “yours” can change your mindset and help you make decisions that benefit both of you.

This can be a difficult shift, especially if you are used to thinking individually. But, once you manage to do so, it can make a world of difference in how you manage your money.

Set your future goals between you

The big benefit of changing your mindset and seeing your money as a joint resource is that it can help you achieve your goals in retirement.

You and your spouse or partner might have similar targets for the future, wanting to go on regular holidays or make certain luxury purchases in later life.

Equally, one of you might have these ambitions, while the other would prefer to set money aside for the benefit of your loved ones. Your spouse or partner might want to help your children or grandchildren onto the property ladder while you want to travel, for example.

Planning together can help you both, as it means you can use and organise your joint wealth to achieve both of your targets.

The key point to remember here is that both of your goals are as valid as each other. Speak openly and discuss your goals as a team, and then organise your wealth accordingly.

By doing so, you make it more likely that you will both achieve what you want, ensuring each of you is satisfied with your retirement lifestyle.

Planning together could help you make your money more tax efficient

As well as allowing you to reach your targets, joint planning can also present an opportunity to make your money more tax efficient. That is because each individual has access to many tax allowances and exemptions. So, working together could help you both make the most of these.

One way you could do this is by paying into your spouse or partner’s pension. This can be especially useful if it is no longer advantageous for you to contribute to your pot in a given tax year.

For example, you may have already used your entire pension Annual Allowance (£60,000 or 100% of your earnings in 2023/24). Or, if you are a high earner, you may be subject to the Tapered Annual Allowance, and might only be able to make as little as £10,000 of tax-efficient contributions to your pot each tax year.

Regardless of the reason, it could be beneficial for you to pay into your spouse or partner’s pension as a result. Contributions up to their Annual Allowance could receive tax relief at their marginal rate of Income Tax, and any interest or returns will be tax efficient.

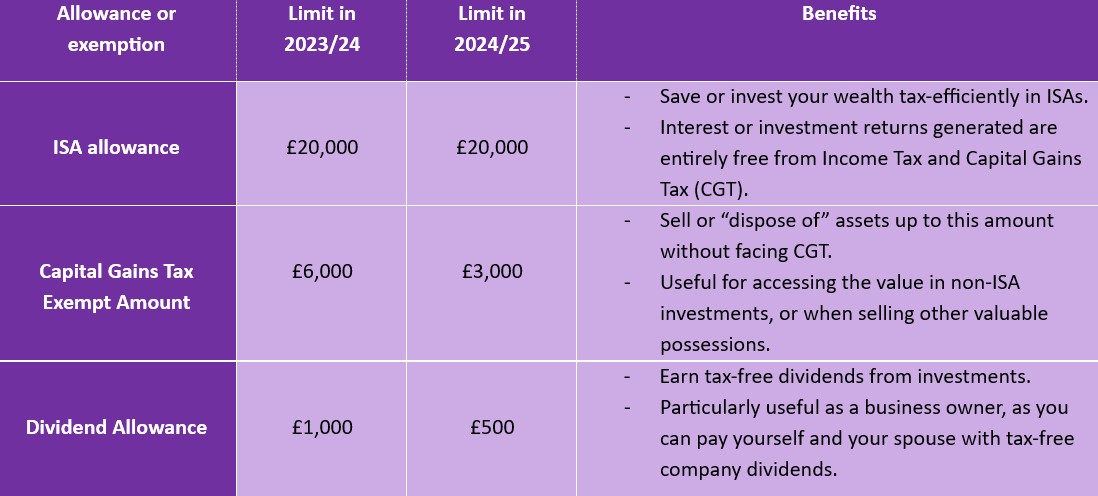

The table below shows details of other tax efficient allowances and exemptions you could consider making use of:

Making the most of allowances and exemptions between you could help you to reduce the overall tax bill you face as a couple, essentially “doubling” your entitlement to each one.

In this way, joint planning can have a tangible financial benefit, as well as helping you to achieve your goals for the future.

Get in touch

If you would like help planning your wealth with your spouse or partner so you can achieve your goals, please do get in touch.

Email enquiries@rosebridgeltd.com or call 01204 300010 today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

The Financial Conduct Authority does not regulate tax planning.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Stonebridge Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd and Stonebridge Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production