In recent months, the government has announced a series of tax rises to address the cost of the social care crisis and support the NHS.

Included among these changes are 1.25 percentage point increases to both the National Insurance and Dividend Tax rates. According to figures from the Guardian, the government expects these measures to raise an additional £12 billion a year for the Treasury.

If you’re a business owner, you may choose to receive part, or all, of your income through dividends. Due to this, your tax bill may increase from the start of the new tax year.

This might make you wonder whether taking your income in this way is still right for you, so read on to find out how the change could affect you and your business.

Your tax bill may increase in the 2022/23 tax year

To raise money to pay for the social care crisis, and address the large backlog of NHS waiting lists, the government has announced several tax increases. These will come into effect starting from the beginning of the next tax year on 6 April.

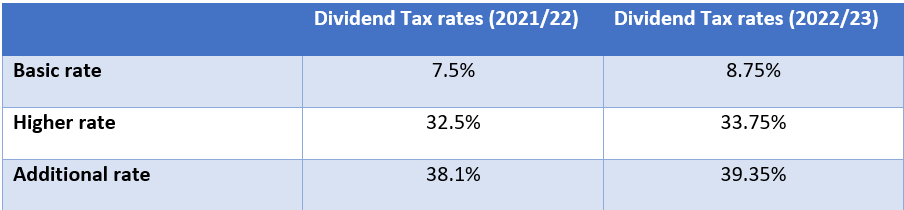

One of the major changes is that, as of this date, Dividend Tax will rise by 1.25 percentage points.

You can see the direct effect that this will have on Dividend Tax rates in the chart below:

Each year, you have an allowance for how much you can earn from dividends before you have to pay tax. In the 2021/22 and 2022/23 tax years, this stands at £2,000. If you earn more than this amount through dividends, your tax bill could soon be about to rise.

For example, if you’re an additional-rate taxpayer who takes £25,000 in dividend payments, then you would have to pay tax on £23,000 of that income. This would mean that your Dividend Tax bill will rise from £8,763 to £9,050.50 in the coming tax year.

Despite tax rises, extracting profit from your company through dividends is still more efficient

If you choose to take a portion of your income from your business through dividends, you may be wondering just how much this change is going to affect you.

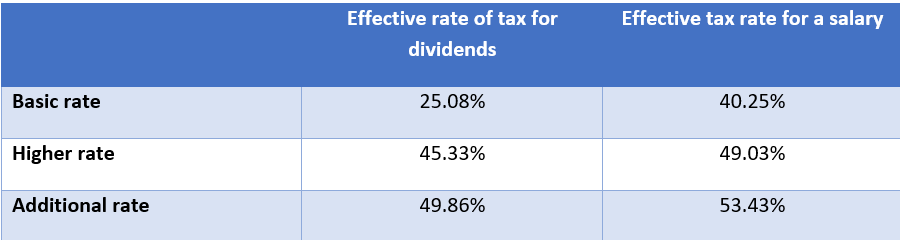

According to data from FTAdviser, in the 2021/22 tax year, the effective rate of tax when drawing a salary or taking a dividend from your company is:

As you can see from the chart, in the 2021/22 tax year it is more tax-efficient to extract profit from your business through dividends than through salary. This is why many business owners prefer to take a small salary, to make the most of their tax allowances, and top it up with other sources of income.

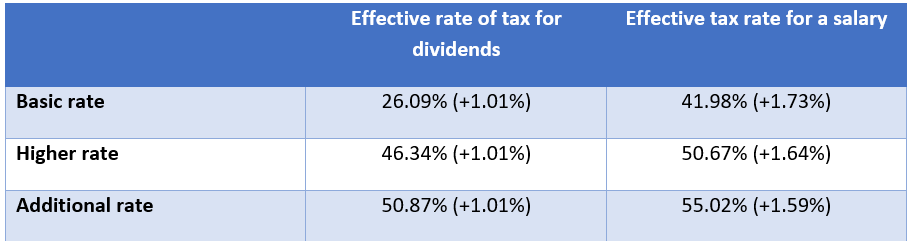

When the changes come into effect in the 2022/23 tax year, the effective rates will look like this:

As you can see, when taxes rise in April, they won’t increase on dividends by as much as they will on any cash salary you may draw. This means that it could be even more beneficial for you to extract profit from your business through dividends.

Pension contributions could be a tax-efficient alternative to a cash salary or dividends

Of course, if you’re concerned about how much the tax rises will affect your progress towards your long-term goals, there are some alternatives. For example, instead of extracting profit through a cash salary or dividends, you could consider taking a portion of your salary through pension contributions.

Companies can make pension contributions for business owners and by doing so, you can potentially take advantage of both Corporation Tax and National Insurance relief. This can help you to build your retirement wealth in a tax-efficient way.

However, it’s important to bear in mind that you would not be able to access this until minimum pension age. Typically, you can’t make withdrawals from your pension until the age of 55, or 57 from 2028.

That being said, this could be a useful strategy if you’re in the run-up to retirement and are hoping to maximise your contributions. If you aren’t sure whether taking a portion of your salary in this way is right for you, you may benefit from seeking professional advice.

Working with a financial planner can help you to make properly informed decisions with your wealth. This can give you a greater sense of confidence that you’re on track to reach your financial goals, despite any obstacles such as tax rises.

Get in touch

If you’re concerned about how the government’s proposed tax rises will affect you and your business, get in touch. Email enquiries@rosebridgeltd.com or call 01204 300010 to find out more about how we could help you.

Please note:

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production