When it comes to your pension, you may well have come across the term “Lifetime Allowance” and wondered what it meant, and if it could affect you.

In this article, you’ll find out what the Lifetime Allowance is, how it works, and how it could have an impact on your retirement planning.

Tax relief makes pensions an attractive savings option

The advantageous tax status applied to pension contributions means that they are one of the most tax-efficient ways of saving for your retirement.

You get basic-rate tax relief on all your personal contributions. This means that for every £80 you pay into your pension, the government add an additional £20.

Additionally, if you pay a higher rate of Income Tax, you’ll get tax relief at your marginal rate of tax. You can claim this additional tax relief back through your self-assessment tax return.

The favourable tax status means your contributions are limited

Because of how favourable the tax position is on pension contributions, the UK government have always taken steps to restrict the advantages available to individuals.

There have always been limits on the amount you can contribute. The current maximum each tax year, known as the “Annual Allowance”, is either £40,000 gross or 100% of your earnings, whichever is lower.

However, bear in mind that you’re able to “carry forward” contributions from the three previous tax years if you’re eligible to do so. This could be a beneficial feature if you have a lump sum to invest.

How the Lifetime Allowance works

In addition to limiting the amount you can contribute each tax year, the UK government introduced the Lifetime Allowance (LTA) in 2006.

This provides an additional restriction on the amount of tax-privileged advantages by limiting the amount of pension benefit that you can contribute into your fund in your lifetime.

This includes employer contributions, tax relief, and any potential investment returns on top of whatever you choose to put into your pot.

If you exceed the LTA, you’ll be subject to an additional tax charge on top of the Income Tax you pay on your pension.

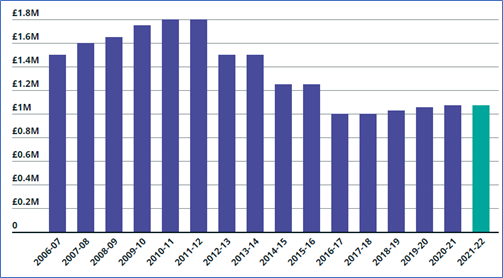

Source: Which?

As you can see from the chart, when it was first introduced, the LTA was £1.5 million. After getting as high as £1.8 million in 2011/12, the value has fallen so that the current LTA for the 2021/22 tax year is £1,073,100.

In the 2021 spring Budget, the chancellor confirmed that the LTA will be frozen at this figure until at least April 2026.

The LTA is the maximum amount you can accrue across all your pension savings. It is calculated differently, depending on which type of pension(s) you have:

- For ordinary defined contribution (DC) schemes, including personal pensions, the calculation is based on the overall value of your total pension funds.

- For defined benefit (DB) schemes, the calculation is based on 20 times the value of your accrued pension at the date you leave service, plus any applicable lump sum.

Taxation of excess sums

There are two different tax charges if you exceed the LTA at the time you come to take your benefits, depending on whether you receive the money as regular income or as a lump sum.

You’ll pay a tax charge of 55% on any lump sum you receive over the LTA. Meanwhile, any amount over your allowance that you take as regular income will incur a tax charge of 25%. In each case, this is in addition to the Income Tax payable.

As you can see, the tax charges make exceeding the LTA potentially very costly. That’s why it makes sense to be aware of it, keep an eye on the value of your pension fund, and take necessary steps to avoid exceeding the LTA if possible.

Get an up-to-date valuation of your total pension fund

LTA calculations can be complex. Get them wrong or make a wrong decision regarding your pension arrangements and you could be faced with an unexpected and unwelcome tax bill.

A key first step is to get up-to-date valuations on all your pension funds. If you’ve lost track of any of your old pensions, the government have a set up a pension tracing website that can help you find details of the scheme administrators you can contact for information.

Once you have up-to-date valuations, you should look at the overall value, the amount you’re currently contributing, and potential investment returns to see if you may have a problem with the LTA in the future.

For example, a net growth rate of 5% on a pension fund valued at £750,000 would mean the fund value would exceed the current LTA in just over seven years – and that doesn’t take into account any further contributions you, or your employer, make.

Possible steps you can take if the LTA could affect you

If the value of your retirement savings is close to the LTA, you may want to consider taking steps to avoid exceeding it and ending up incurring a potential tax charge.

These steps could include the following.

- If you’re close to your planned retirement date, you might want to consider stopping pension contributions and retiring early.

- You could reduce the amount you pay into your pension and divert some of your contributions to other savings and investment options, such as into an ISA or invested in stocks and shares.

- If you’re eligible, you could apply for “Individual Protection 2016”. This will give you an LTA of the value of your fund value as of 5 April 2016, up to a maximum of £1.25 million. Clearly you should only do this if it’s advantageous to do so. Bear in mind that you may still have to pay tax on any savings you withdraw that exceed your higher protected LTA.

- Alternatively, you may be eligible for “Fixed Protection 2016”, increasing your LTA to £1.25 million. However, you won’t be able to make any more contributions to your pension. If you do, you’ll lose your protection and have to pay tax on funds that exceed the standard LTA.

The LTA and your retirement planning

It might sound counterintuitive but, depending on your circumstances, exceeding the LTA may not be the worst thing that could happen.

While the additional tax charge could reduce the income you can take from your fund, remember that the charge only applies on the excess above the LTA. You will still only pay the appropriate level of Income Tax on all amounts you take from your fund up to the LTA maximum.

If you’re a higher- or additional-rate taxpayer, you’ll be getting 40% or 45% tax relief on your pension contributions, which can help offset some of the impact of the additional tax charge.

So, you may be able to manage your retirement income planning and make use of tax allowances to only pay basic-rate tax on income you take from your pension fund.

Your investments will be growing free of any Capital Gains Tax (CGT) liability, and there may also be Inheritance Tax benefits of leaving a pension to loved ones.

Clearly, it’s a decision that you’ll need to carefully consider, and we would always strongly recommend that you take financial advice before proceeding.

Get in touch

As you’ve probably realised from reading this article, managing your LTA may not be straightforward, and any mistakes could prove costly and leave you facing an unwelcome tax bill.

If you’d like to talk to us about your LTA and how it could affect you, please get in touch with us at Rosebridge.

You can email us at enquiries@rosebridgeltd.com or call 01204 300010.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

A pension is a long-term investment. The fund value may fluctuate and can go down. Your eventual income may depend on the size of the fund at retirement, future interest rates and tax legislation.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production