With the first semester of a new academic year about to begin, you may have children or grandchildren heading to university for their first year, or back for their next year after a summer break.

Of course, one of the biggest discussion points around university education relates to fees and costs. Universities can now charge up to £9,250 a year (£9,000 in Wales) in tuition costs for an undergraduate degree.

That only covers the cost of your child or grandchild’s education, and not whatever they will need for food, rent, bills, and other living expenses.

Typically, students have two options for paying for university:

- They can apply for student finance from the Student Loans Company (SLC).

- They can ask for support from family to help them cover the costs.

You may well have always envisioned paying for your child or grandchild’s university fees. Or, you might think that student finance is a more cost-effective way for them to effectively self-fund their education.

So, find out how much university costs, and the benefits and drawbacks of student loans against paying for your child or grandchild’s education.

Student finance offers loans specifically for university goers

By applying for student finance from the SLC, students can borrow money to pay specifically for university education.

Students can apply for one or both of:

- Tuition Fee Loan – This money is paid directly to the university to cover the costs of a student’s course fees.

- Maintenance Loan – Students can also apply for money to help them pay for living costs. It’s important to note that this is means-tested on your child or grandchild’s household income (essentially, their parents’ income). As a result, even if they take this money, they may receive less if their household earns a certain amount.

As with most forms of borrowing, students are charged interest on their loan. This is applied from their very first day of university.

Aside from the interest, a student loan functions very differently from ordinary borrowing.

Students only start paying back when they reach a certain earnings threshold. This figure is set to change for new university starters – find out more below.

These repayments are deducted directly from their income each month. As a result, many commentators liken student loan repayments to a “graduate tax”, rather than thinking about it as a loan.

Student loans won’t be included in your child or grandchild’s credit report, either, so won’t affect their affordability for future borrowing, such as for a mortgage.

Furthermore, it will also be wiped after a certain number of years or in certain circumstances, such as the death of the borrower. You can read more detail on this below.

All in all, this can make student loans fairly attractive, as they may not negatively affect your child or grandchild in the long term as other forms of borrowing can.

Changes coming into place this year will likely make loans more expensive for new starters

However, while taking out a student loan can allow your child to borrow money without the constraints of regular debt, there’s still a cost for doing so.

This is especially the case if your child or grandchild is starting university in or after September 2023, as the way the loans function is dramatically changing.

There are three key changes coming into place this year:

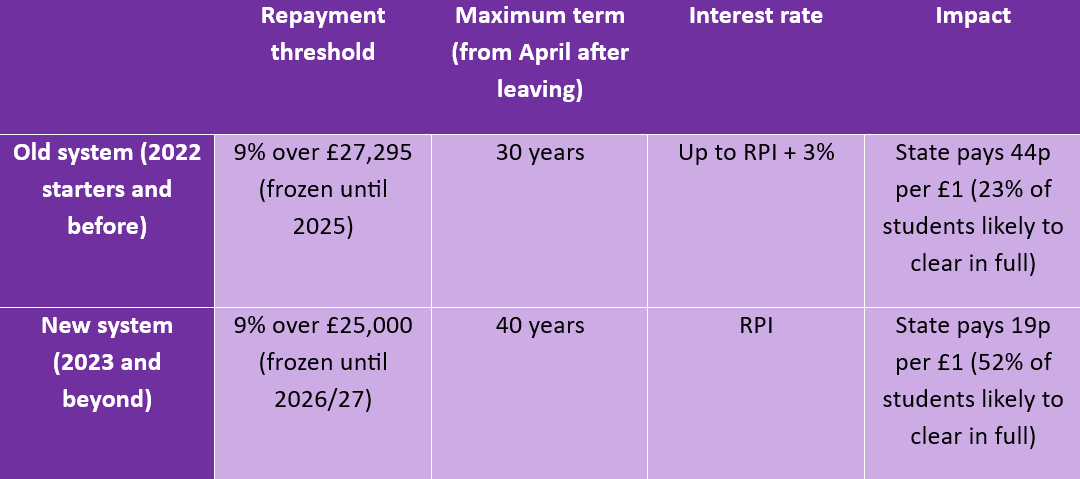

- The earnings threshold before graduates must start repaying their loans is reducing for new starters, down from 9% on earnings over £27,295 to £25,000. As a result, many students will start repaying money sooner, and on more of their income.

- The maximum term before the loan is wiped is increasing from 30 to 40 years. This will see students pay back their loans for longer, which will likely increase the total amount they pay back.

- The interest rate applied to the loan is changing from the Retail Prices Index (RPI) plus 3%, to just RPI. This will reduce how much interest is applied to new students’ loans.

The table below shows how this will all work, relative to those who are already studying:

Source: MSE

As an example, that means a graduate in England with a salary of £30,000 would pay back £243 a year under the old system. Under the new system, this would be £450 a year.

So, if your child or grandchild is heading off for the first time this year, they’ll likely be worse off than those before them.

More significantly, these limits can change over time. That means your child or grandchild could end up paying more in future.

You could alleviate the graduate tax by paying for your child’s fees

While it might be easier to think of it as a graduate tax, there’s clearly still a cost to pay when using student loans. That’s why you may be considering paying these costs for your child or grandchild entirely.

This will certainly be more cost-effective for them, because it means they won’t have to pay money back to the SLC from their income in future. There’ll be no interest charged either, because there was no money borrowed.

In turn, this could help them make the most of their earnings, rather than paying back a portion of their income each month – even if this is limited to 9% above whichever threshold they are subject to.

Interestingly, there may be Inheritance Tax (IHT) benefits in paying for your child or grandchild’s university fees, too.

Using your wealth to do this could reduce the total size of your estate. If you exceed key IHT limits, doing so could help your family pay less IHT when you pass away.

Read more: Are your family at risk of having to pay a large Inheritance Tax bill on your death?

Furthermore, gifts to your family are potentially exempt from IHT if you gift regular money directly from income. This must not affect your standard of living.

This could allow you to pay their maintenance costs at university, allowing you to make these gifts free from IHT.

So, it may be beneficial for both you and them to pay for their education.

The most cost-effective choice will depend on your circumstances and preferences

Ultimately, the most cost-effective choice between paying for your child’s fees or them taking out a student loan will come down to your personal circumstances.

It will almost certainly be more cost-effective for them if you pay the costs upfront. Meanwhile, if you have a sizable estate and plan to gift your child or grandchild money in future anyway, this could be a highly tax-efficient way to do so for IHT purposes.

That said, as student loans don’t function as normal borrowing does, it may not be the hefty weight it appears to be.

It could also be a useful tool for teaching your child or grandchild the importance of budgeting and careful spending. Knowing that they’ll have the graduate tax to pay in future could mean they’re more careful with the money they earn after university.

Of course, you could always get the best of both worlds, perhaps paying for their maintenance costs while they take out a student loan for tuition fees. This will reduce the total amount they owe back, while still giving them a helping hand financially.

Get in touch

If you’d like support organising your wealth for the benefit of your family, please do get in touch with us at Rosebridge.

Email enquiries@rosebridgeltd.com or call 01204 300010 to speak to us today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate tax or estate planning.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production