Compared to employed individuals, business owners have a slightly different tax landscape to navigate. Not only do you have to think about the taxes that your business is liable for, but you also have to carefully watch your personal tax liability when withdrawing money from your company.

Interestingly, this process will also continue with how you manage your retirement income. In fact, how you access the money you set aside throughout your time running your business is arguably just as important as saving it in the first place.

Fortunately, there are plenty of ways for you to ensure that your retirement income is as tax-efficient as possible.

Read on to discover four helpful methods that could allow you to reduce your tax bill in later life.

1. Draw money efficiently to reduce your Income Tax bill

When you own a business, you have a great deal of control over how much Income Tax you may have to pay. You can design a strategy that works for you, drawing a tax-efficient salary to limit the amount of Income Tax you’re liable for.

The same can be said of your retirement income. Although you’re no longer working, your income in retirement is still subject to Income Tax.

As a result, whether it’s from your pension or other taxable sources of income, it’s worth thinking about drawing your money efficiently to reduce your Income Tax bill in this period of your life, too.

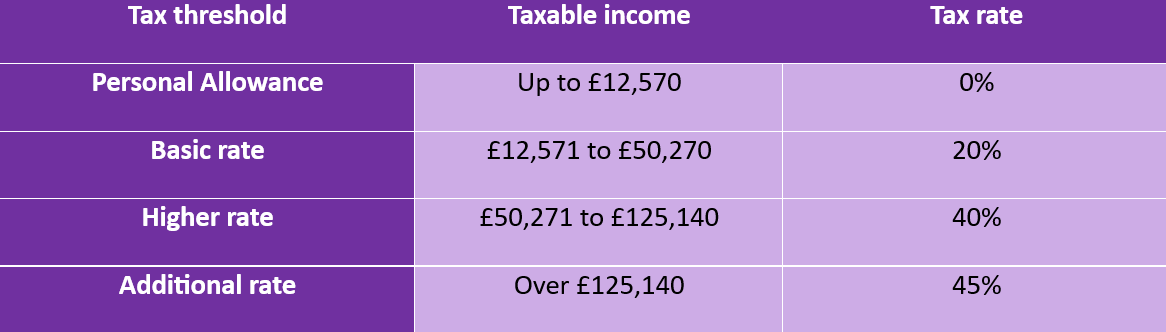

The Income Tax thresholds in the 2023/24 tax year are shown in the table below:

You may be able to draw your income in such a way that allows you to remain below the Personal Allowance, meaning you won’t have to pay tax at all.

Of course, if you’ve had a higher income throughout your working life, you may instead want to focus your attention on staying below the higher-rate threshold of £50,270.

If you paid 40% or 45% Income Tax on your income while you were working in your business, moving into the basic-rate band may still present a tax saving for you.

This is especially the case if you contributed money to your pension and received 40% or 45% tax relief on your contributions. Withdrawing this money from your pension while only paying 20% tax on it makes this a significant saving.

Make sure you consider the Income Tax bands and where you can fit between them to limit your tax bill.

2. Make careful use of the pension tax-free lump sum

When you reach the normal minimum pension age (55 in 2023/24, rising to 57 in 2028), you’ll be able to start accessing your pension.

As part of this, you can take the first 25% of the total value of your pensions tax-free.

You can take your tax-free lump sum all at once in a single withdrawal, or spread it out across multiple withdrawals.

Alternatively, you could take multiple lump sums, with each one being 25% tax-free and the remaining 75% being subject to tax.

The only limit here is that this must not be more than 25% of the Lifetime Allowance (LTA). For most individuals, this will be £268,275, although it may be higher if you have a protected LTA.

Whatever way you decide to make use of it, this can make a significant difference to the tax efficiency of your retirement income. So, carefully draw your tax-free lump sum to make the most of it.

3. Live on wealth that may be subject to Inheritance Tax in future

Your beneficiaries may have to pay Inheritance Tax (IHT) on your wealth in future if the value of your estate exceeds the nil-rate band. In 2023/24, this is £325,000.

You may also be able to make use of the additional residence nil-rate band (up to £175,000) if you pass your main home to your direct descendants.

In total, that means you can pass on up to £500,000 IHT-free, or £1 million as a couple. However, any value over this may be subject to 40% IHT.

Fortunately, you can reduce this tax liability for your family by carefully managing your retirement income.

For example, your savings and other investments will usually be included in the calculation of your estate. Meanwhile, a defined contribution (DC) pension will typically fall outside your estate for IHT purposes.

So, if you choose to live on those IHT-liable assets first and largely left your pension untouched, you may be able to pass on more wealth tax-free.

4. Work with an adviser

Perhaps the most helpful choice you can make is to work with an experienced financial adviser.

At Rosebridge, we can help you manage your wealth now and in retirement so you can make it work for you. We’ve assisted many business owners just like you to organise their wealth for life after leaving their enterprise.

We’ll help you consider the tax-efficient strategies that are most suitable to you in your personal circumstances.

We’ll always do this with your goals for the future in mind, ensuring that you’re on track to live the kind of lifestyle you want in retirement.

If you’d like help from a team of experienced professionals, please speak to us at Rosebridge.

Email enquiries@rosebridgeltd.com or call 01204 300010 to get in touch today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until age 55 (57 from April 2028 unless the plan has a protected pension age). The value of your investments (and any income from them) can down as well as up which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation which are subject to change. You should seek advice to understand your options at retirement.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ.

Rosebridge® is a trading style of IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd, Park Square Wealth Management Ltd and Independent Financial Advisor Ltd. IFA (North) LLP, Pro Sport® Wealth Management Ltd, Rosebridge (Skipton) Ltd, Stonebridge Wealth Management Ltd and Park Square Wealth Management Ltd are all appointed representatives of Independent Financial Advisor Ltd which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No 05246224. Registered address: The Grants, 11 Market Place, Ramsbottom, Bury, BL0 9AJ. Production

Production